Seamless

- Fully integrated with Finastra Phoenix for touch-free implementation

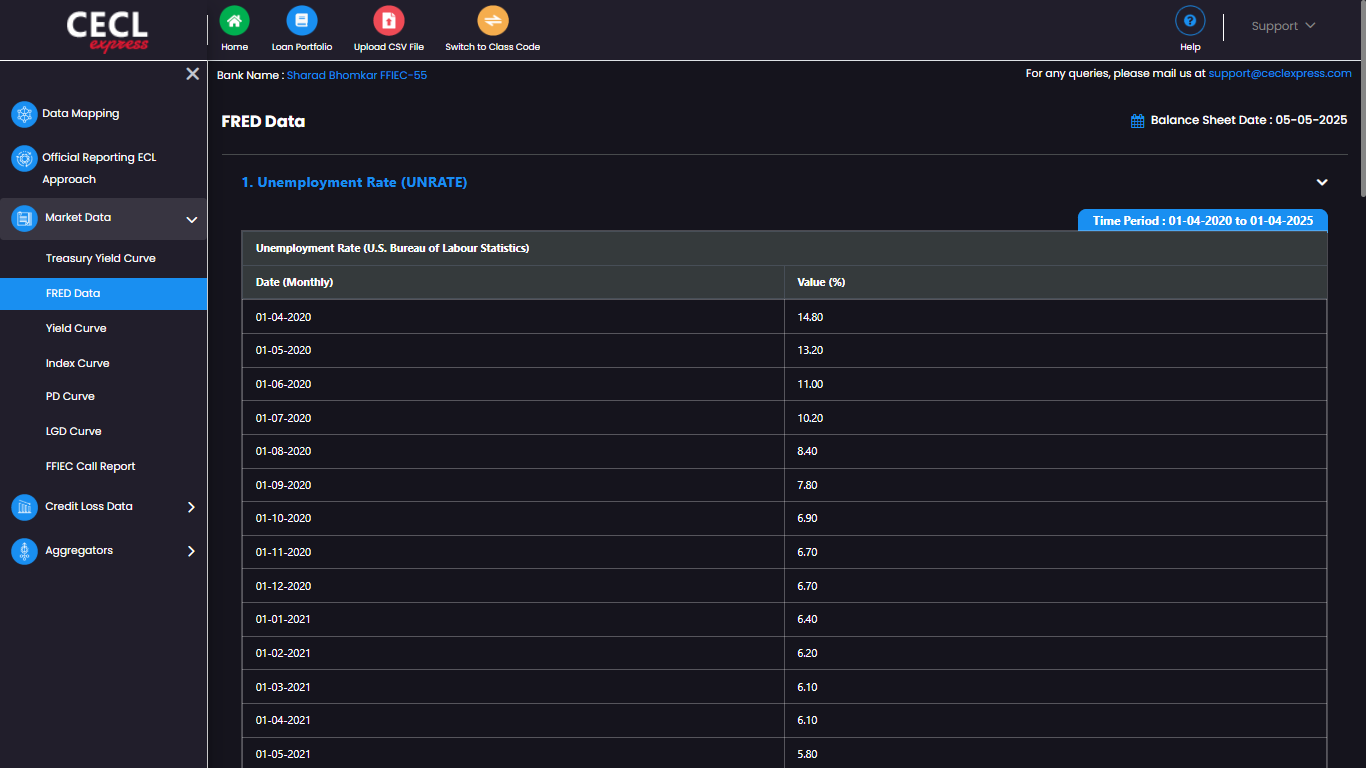

- Data from Fed, FRED and FFIEC built into solution

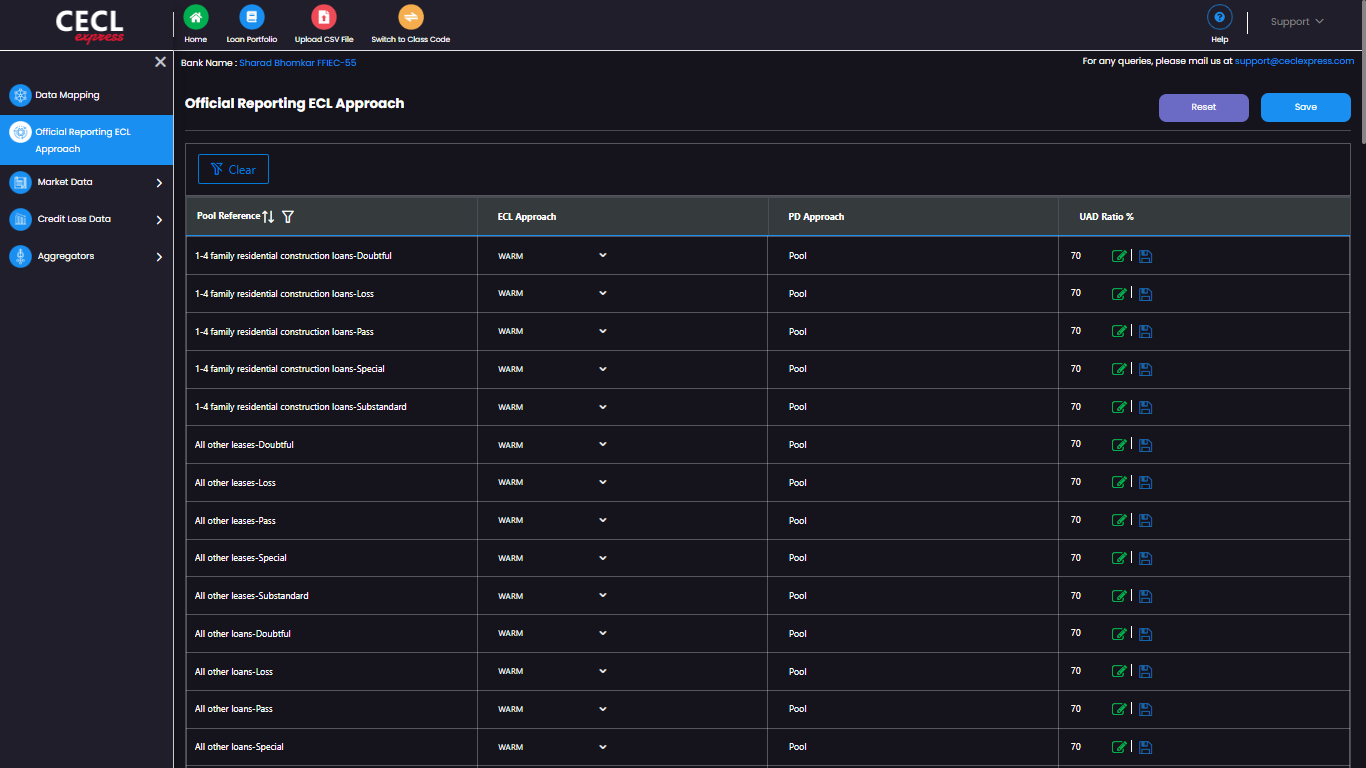

- Full user control over loan pooling, Q-factors, and scenario definitions

Optimized

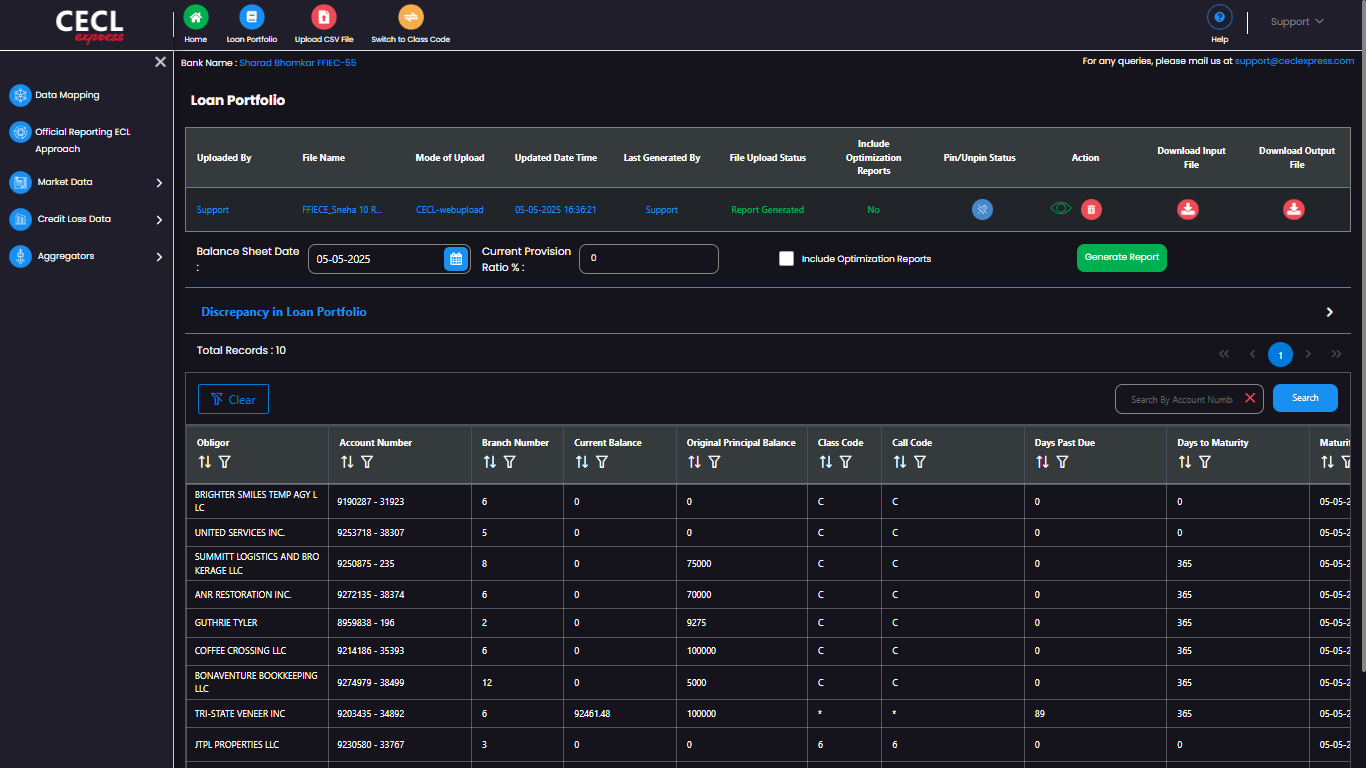

- Calculates capital for multiple CECL methods by pool for each scenario

- Provides graphical and tabular breakdown for the lowest, most efficient CECL projection

- Provides detailed breakdown for each pool and scenario

Intuitive

- Designed to provide effective CECL reporting out of the box

- Built on Power BI to give intuitive and click-through user experience

- All data and inputs are readily accesible for full auditability

Road to CECL

• CECL is a regulatory measure as a direct response of 2008 credit crisis.

• CECL is FASB’s (Financial Accounting Standards Board) mechanism to account for possible future credit losses.

• CECL will create the need for higher capital provision across the US banking sector.

• Analysis : Banks held insufficient capital to cover credit related losses

• Stress Testing (DFAST)

• Liquidity Ratios (LCR and NSFR)

• IFRS9 - IASB

• CECL - FASB

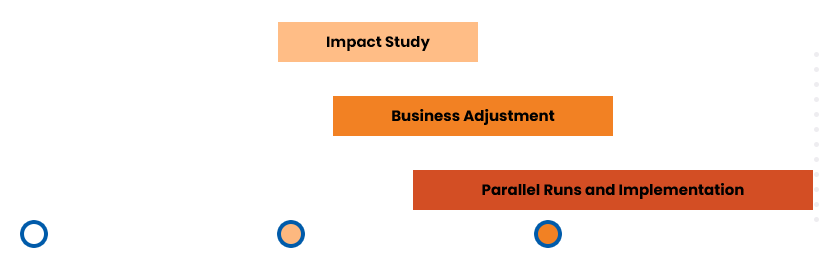

CECL Implementation Schedule

• Non-SEC filers are required to officially report CECL numbers From December 31, 2022

• Recommended best practice is a 12-month parallel run

• Business adjustment is estimated at 6 – 12 months

• Impact study on P&L is expected to take 3 – 6 months

CECL Implementation Considerations

• Banks must pool their loans appropriately.

• Banks must select the most suitable CECL methodology at the pool level.

• Banks may apply location specific qualitative factors to the macro-economic data used within these methodologies.