Product & Services

Minimal

Implementation

Effort

Multiple Expected

Credit Loss (ECL) Choices by Loan Pools

Comprehensive and

Rigorous Audit

Support

Best-in-class Intuitive

User Experience

Required Market

Data Included

Comprehensive and

Rigorous Audit

Support

Short Implementation Period

Current Expected Credit Losses (CECL) methodology guidelines require credit unions and banks to adopt the new standard no later than January 2023. Banks and credit unions must start system evaluation, selection and implementation. With this CECL implementation date, they do not have the option to delay this any further.

CECL EXPRESS is a unique industry-lending solution created from the ground up. It is natively integrated with Finastra core systems and requires no other data except the loan portfolio specifics from any bank or credit union. If your underlying loan system is a Finastra core (including Loan IQ, Phoenix, and Ultra Data). Because your loan book is already mapped into the system, users can be up and running on CECL EXPRESS™ within a week. It calculates the provision using multiple CECL methodologies for each individual scenario.

Other non-Finastra core banking systems can be mapped easily in just days.

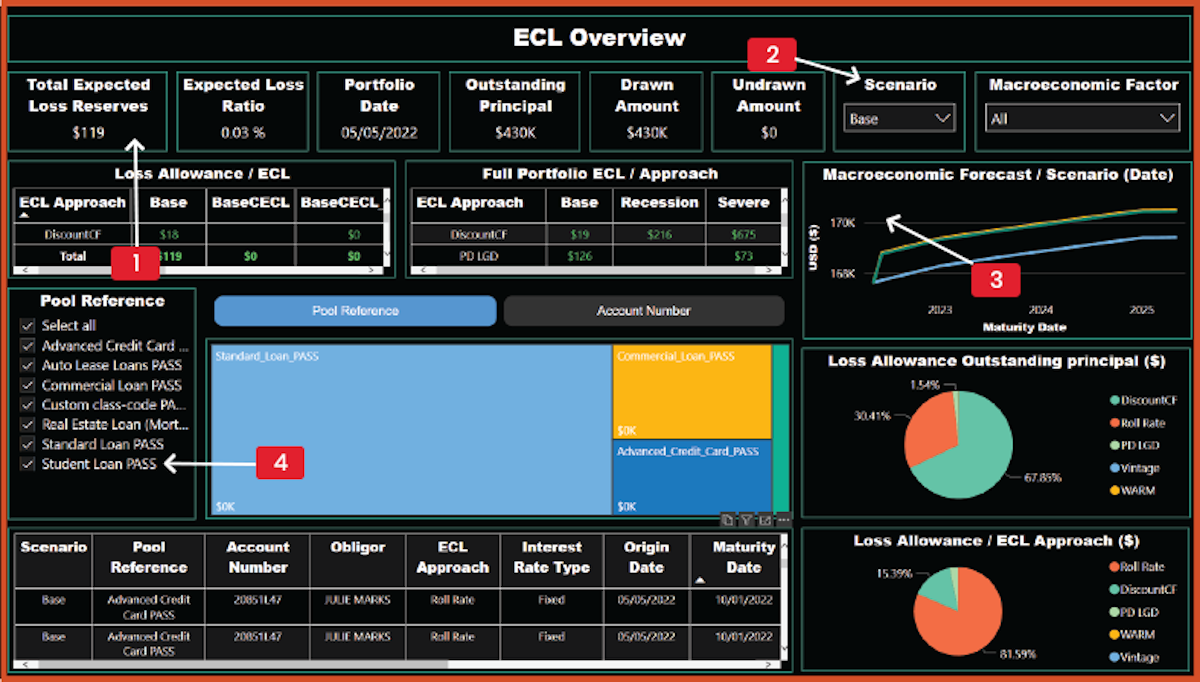

ECL Dashboard

- Full CECL result and loan book details

- Multiple economic scenarios from base level to severe recession

- Macroeconomic factors displayed graphically

- Graphical and tabular breakdown of ECL by pool and loan

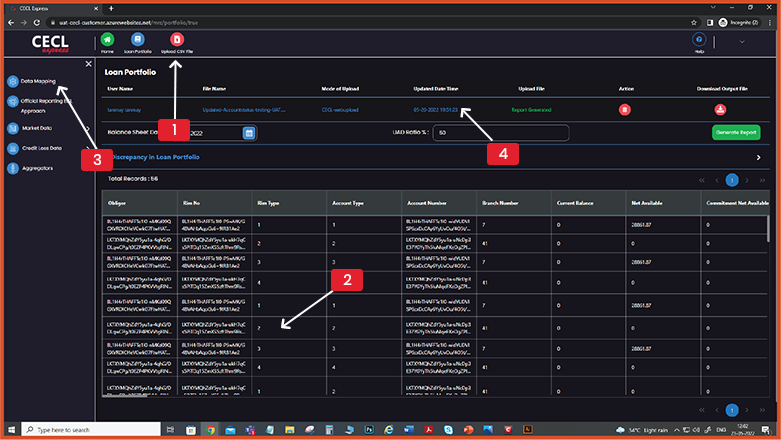

Loan Portfolio Dashboard

- Intuitive navigation around the system, for analysis and audit

- Full loan details displayed to ensure data integrity

- All portfolio data mappings fully explained

- Portfolio summary upload details shown for veracity

Multiple Implementation Choices

CECL EXPRESS allows maximum flexibility in model choice for adopting the new accounting standard. This enables you to continuously optimize liquidity, P&L and manage capital and required loss provisions.

Banks and credit unions can select from five approved methods:

- Vintage

- Roll Rae

- Discounted Cashflow

- Weighted Average Remaining Maturity

- Probability of Default/Loss Given Default

Intuitive and Robust Audit Support

Justifying ECL model selection and results to auditors and bank examiners will be the most challenging aspect of complying with CECL requirements. There are two key considerations for supporting effective audit and bank examination functions.

- A clear and tractable path and audit trail from ECL results through the underlying data used and loan level result.

- Ease of input data management through structural location, access and stepwise analytics.

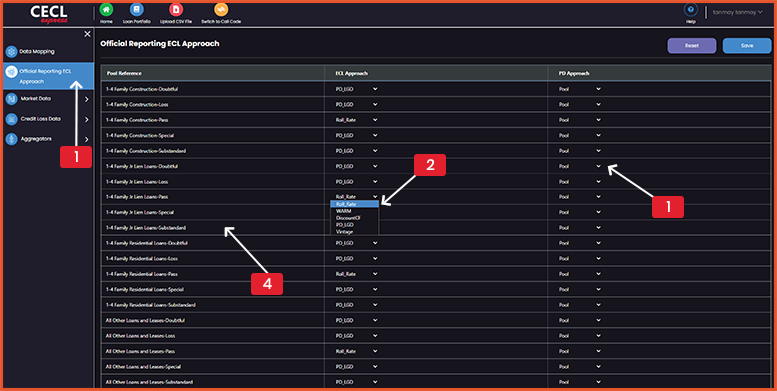

Reporting Dashboard

- Dedicated screen for users to select ECL methods by pool

- Choice of five approved methods

- Choice of five approved methods

- Every pool used by the bank listed by call or class code

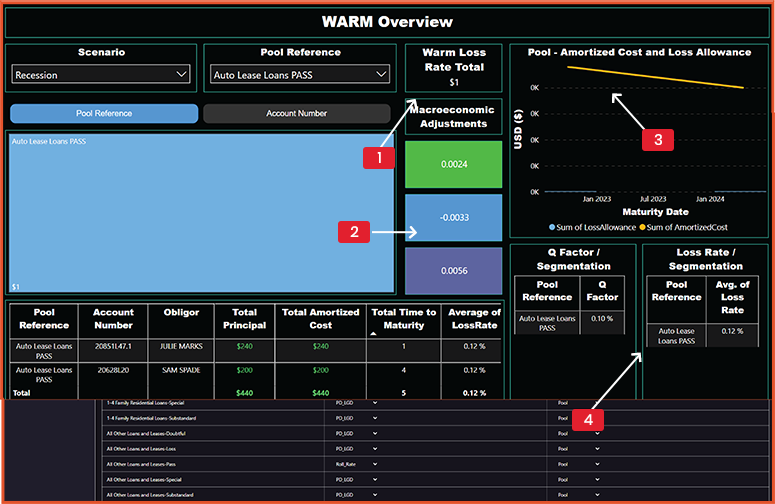

WARM Approach

WARM Overview

- Specific results for all pools using the WARM methodology

- Macroeconomic factors used in the ECL computation

- Graphical representation of amortized cost and loss allowance

- Unadjusted loss rate for each pool using the ECL method

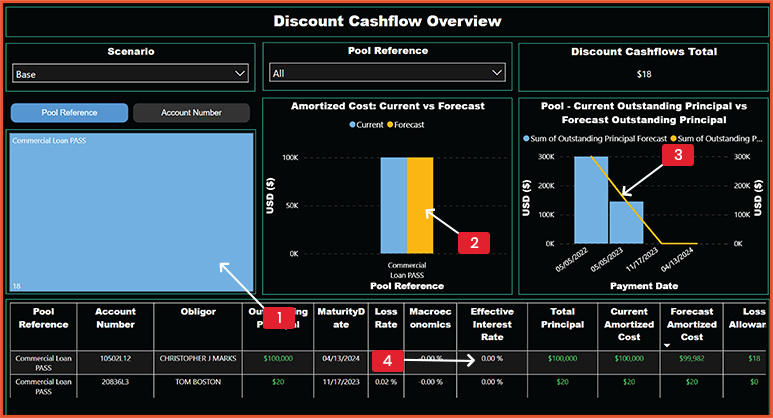

Discount Cashflow Approach

Discount Cashflow Overview

- Visual breakdown by pool and account

- Amortised cost breakdown of loans using the DCF method

- Analysis of loan book by principal

- Loan level results including EIR and other contributing calculations

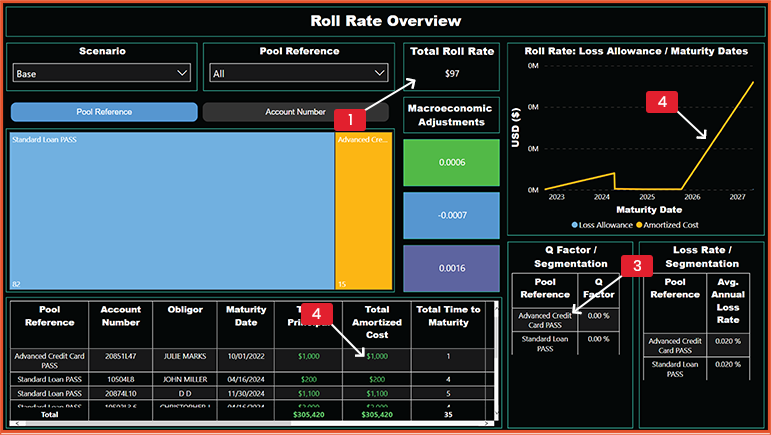

Roll Rate Approach

Roll Rate Overview

- Specific results for all pools using the roll rate

- Loan by loan breakdown of roll rate specific results

- Relevant Q factors applied to the loss calculation

- Graphical representation of ECL by loan maturity

CECL EXPRESS provides deep dive analysis for each combination of prescribed ECL method and loan pool. This enables senior managements, auditors, and examiners to review and validate the data and results of the CECL analysis.

Provision of all required market data

ECL models are only as good as the data that feeds them. It is an imperative for the CECL implementation that all market data used for the audit and supervisory submissions, and that all inputs and results are available and easily tractable.

A CECL EXPRESS system provides the following data elements:

- FFIEC/NCUA call reports

- Yield curves

- PD curves

- Peer group losses

- Market data needed for all ECL methods

Banks or credit unions have to provide only their specific loan information. This institution-specific confidential portfolio data is viewable on the dashboard for analysis and reporting.

Explore our CECL products and services that help you to analyze and optimize the credit loss data.

CECL Products & Services Brochure