The Client

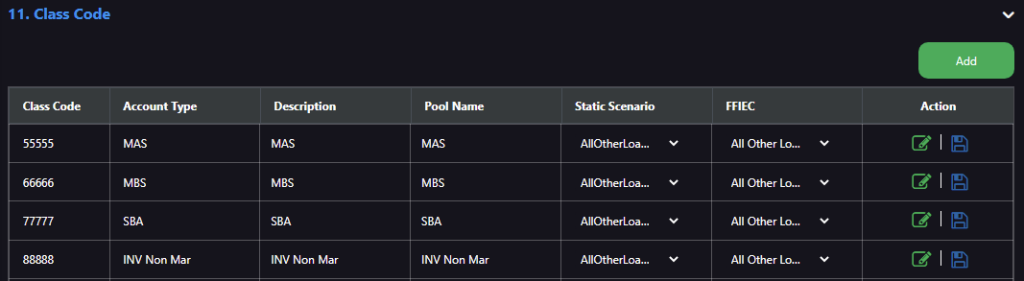

- Institution type: Community Bank

- Balance sheet size: $750m – $1b

- Number of active loan pools: 47

- Pool Designation Class or Call codes: Class Code.

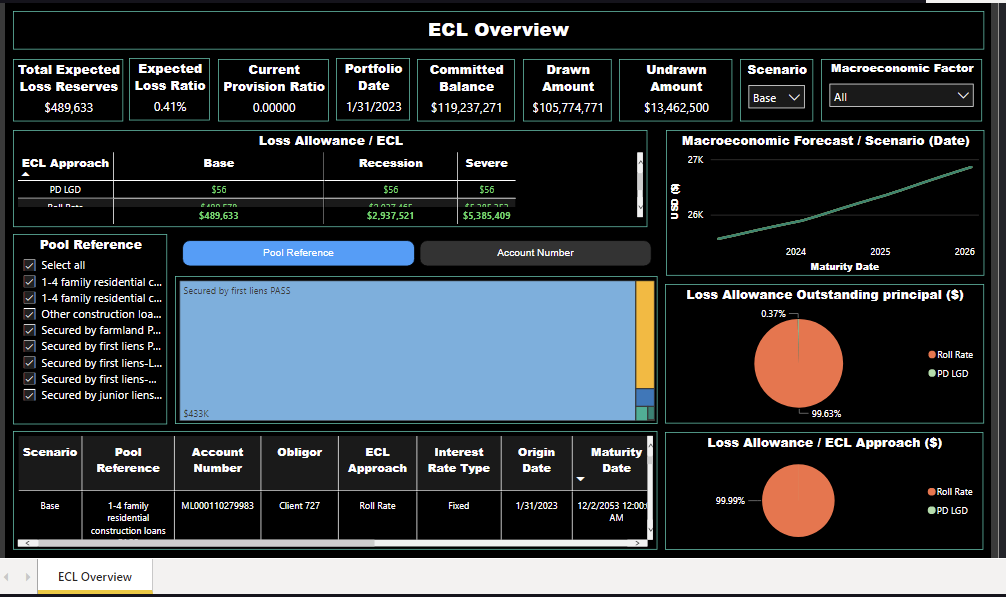

How CECL Express helps

Choices available to calculate Expected Credit Losses (ECL):

The client is using the Roll-rate method out of the 5 options provided in CECL Express.

- Roll-rate method

- Probability of Default/Loss Given Default (PD/LGD) method

- Discounted Cash Flow (DCF) method

- Weighted-Average Remaining Maturity (WARM) method.

- Vintage method

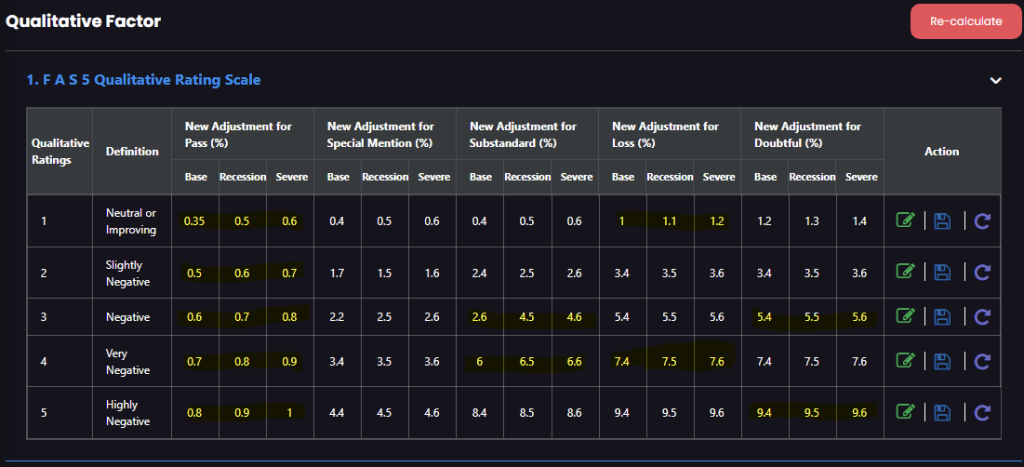

Risk designation:

Pools are split by risks according to days overdue using the formula below, which is customized for the client.

Days Delinquency Adjustment

0-29: Pass

30-60: Special

60-90: Substandard

90-120: Doubtful

120+: Loss

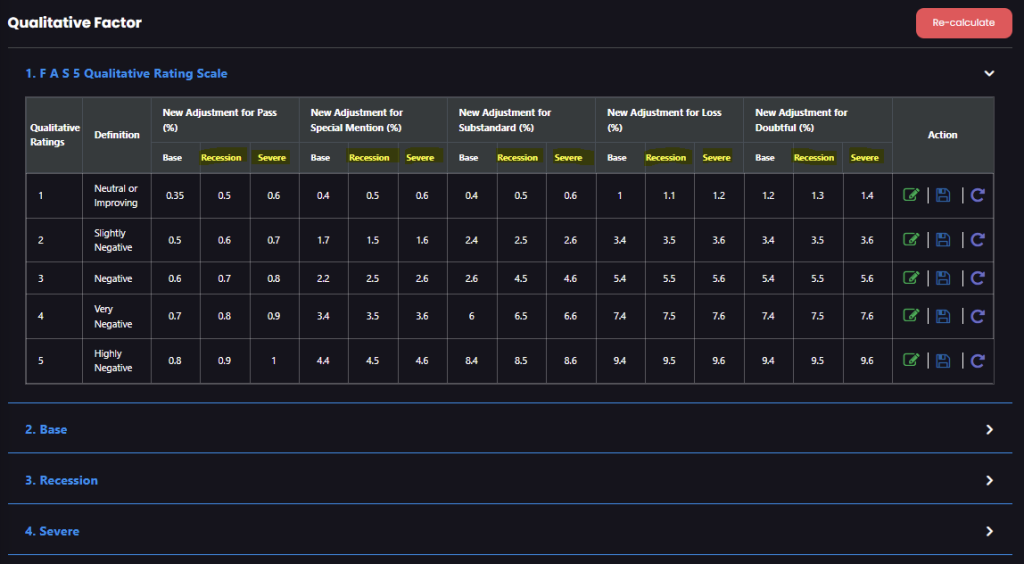

User-controlled Q-factors:

Q-factors have defaulted into the system where the highlighted part is customized by the bank as per their historical experiences.

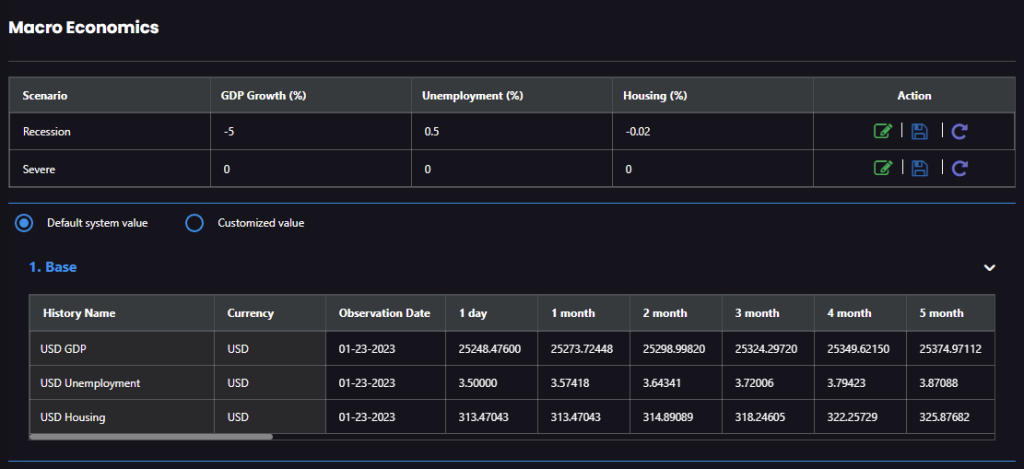

Market data sourced by CECL Express:

- Economic data – Federal Reserve Economic Data – https://fred.stlouisfed.org/#

- Call report – FFIEC Call Report

- Yield curves – US Treasury Yield Curves

- Macro-economics

The macro-Eco data curve is forecasted using the FRED data considering the GDP, Housing, and unemployment factor.

Liquidity Stress Scenario

CECL Express offers two stress scenarios- Recession and Severe Recession.

Scenario Impacts are added to the Annual loss rate and Qualitative Factors by the Banks.

E.g.

Time taken to implement CECL

10 days.

Portfolio linkage

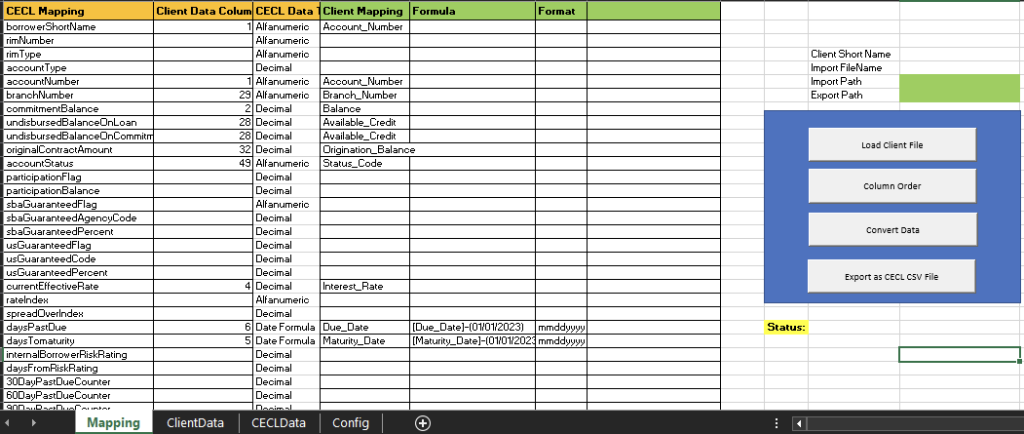

Portfolio mapped by the CECL Express team, using ETL tool to speed up and simplify the implementation process.

Obstacles faced during implementation

- Bank portfolio had separate off-balance sheet item, which was not included in the portfolio. The CECL express team mapped the off-balance sheet item in the portfolio to include them in the same calculation.

- Revolving loans like credit cards had days to maturity as 0, due to which they were excluded from the calculation and creating discrepancies. The CECL express team manually mapped the default maturity dates to such loans to resolve the issue.

Final Report Example