Liquidity and CECL

The Financial Accounting Standards Board (FASB) considers a few parameters as necessary for calculating expected credit losses for banks and other financial institutions while implementing the Current Expected Credit Losses (CECL) accounting standard. These parameters are listed below:

- Current conditions

- Historical experience and information about past events

- Reasonable and supportable forecasts

CECL measures expected losses related to financial assets, but because it measures how much capital to hold as a bank, it can also be seen as a liquidity measure. Therefore, it can influence if financial institutions are going to be short of capital after estimating their reserves and if that could lead to a capital problem and a liquidity problem. Once institutions consider this liquidity aspect that accompanies CECL implementation, they can prepare for any adverse situations that may arise in the future.

Constructing scenarios while planning CECL

The collectability of financial assets will depend on the adjustments of reasonable and supportable forecasts along with the historical loss rates. This can be achieved by modeling elements such as stress scenarios and economic shocks. Historical loss information should be adjusted, as necessary, to reflect the reasonable and supportable forecasts that are not already reflected in the historical loss information. Qualitative and quantitative factors will have to be incorporated when estimating CECL allowances.

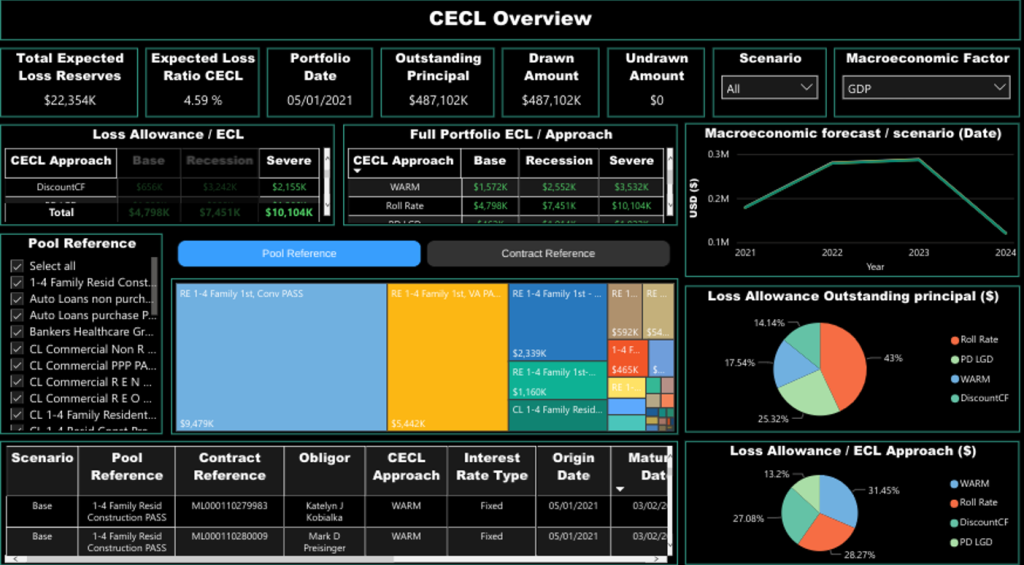

Although no specific estimation methods are prescribed under CECL. The allowances for credit losses can be determined using several reasonably accurate methods. Some of these methods include:

- Probability of default/loss given default method

- Loss rate method

- Vintage analysis

- Roll-rate method

- Discounted cash flow analysis

Any of the above estimation methods can be applied to different financial asset groups, provided the bank’s credit loss estimates are well supported. Banks can develop several defensible scenarios based on the right economic theory to become CECL compliant. These scenarios help them assess lifetime credit losses using various assumptions. In a recession, several macroeconomic factors can work against the recovery of credit in banks. As a result, default probabilities increase, and losses in the event of a default worsen. Not only do the Gross Domestic Product (GDP) and other economic variables come down, but also, more people default on the same credit score.

For example, if 0.1 percent of people default on a credit score of 800 or 750 during a regular time, 0.2 percent of people default in a recession because they are being impacted by all the negative economic factors that follow a recession. It is difficult for banks to predict exactly who will get affected the most from this until it actually happens. Such data is generally easy to pick from historical losses as opposed to predicting it.

Credit loss data lags recessions

Losses that drive expected loss calculations by their very nature lag recessions and potentially leave banks unprepared for the impact. All the indicators in terms of how people default lag the market. For example, right now, someone with a credit score of 750 has a historical 0.1 average of defaulting. But if we went through a 6-month depression, we would see that default percentage go up considerably. But this default probability will not be recorded in the numbers until much later. Therefore, what can we do about that? As mentioned earlier, banks can build scenarios that actually facilitate the estimation of losses. They have to factor in what happens when GDP falls. What happens if the default ratios increase? What happens if the loss-given defaults go up? When house prices fall, even when the asset is recovered, it sells for less than what is expected. All of this data needs to be factored into the system.

Liquidity and the benefits of constructing scenarios

Liquidity basically means how much cash banks have ready in their system to use for any contingencies and investment purposes. If their CECL provision goes up, they will have less cash. A bank makes money by having cash in the market. Some of the factors that can influence liquidity within banks and, consequently, CECL provisioning include:

- Disposable incomes

- Size and complexity of portfolios in institutions

- Unemployment

- Inflation

- Market volatility

How do banks know if their provision is going to go up? If the markets deteriorate and they have to increase their provision, how do they do that? One of the measures they can use is to sell their assets, such as loans, to another bank. Banks in contingent cases such as recessions have to get their assets off their balance sheets and turn them back into cash to get the CECL provision where it has to be. That is called a contingent liquidity plan which involves liquidity stress testing based on various scenarios.

Constructing scenarios for internal uses allows banks to do two things

- Monitor liquidity buffers

- Select CECL methods that are least sensitive to deteriorating conditions

Therefore financial institutions have to be able to build in scenarios as part of their initial CECL calculations. It should tell institutions such as banks something more interesting about their liquidity position so that they can use the system to monitor this liquidity position to know what they might need in a recession-like situation. By having a Liquidity contingency plan in place, banks won’t need to have the cash ready for a massive economic fallout immediately. Still, they will have a plan prepared on how to access this cash should the need arise.

A bank’s liquidity contingency plans include the following:

- Identifying contingent liquidity events

- Assess funding needs by judging the severity of these events

- Identify potential sources of funds, such as loans that could be sold off

- Establish a mechanism to monitor and manage events

Under a liquidity contingency plan, a bank needs to decide if it wants to sell assets or if it wants to sell loans to increase liquidity. There has to be a way to get back to a liquid position. Banks can increase liquidity within their system and be prepared for any contingencies by using the below-listed measures.

- Sale of assets

- Reduction in cash consumption activities

- Bond issuances

- Setting up crisis management committees

- Conducting dry runs of liquidity stress tests periodically

Planning for future liquidity scenarios can change the CECL methods banks choose. CECL provisions need to be compared between different methods for various scenarios, such as a recession or maybe a severe recession. Accordingly, a CECL method with the right sensitivity needs to be chosen.

CECL is all about planning

To conclude, there is more to CECL than just reporting. There is actual planning. There is the planning of CECL itself, which impacts the model, and there is the planning of liquidity. Liquidity contingency plans can be managed effectively through proper supervision and regulation. So, whenever we choose or design a CECL solution, we should think about the additional liquidity requirements that can be incorporated by that solution. This will kill two birds with one stone. Therefore, it becomes even more crucial for financial institutions to choose their CECL solutions provider carefully, considering we are in the final month leading up to CECL implementation in the new year.

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.