IFRS 9 and the DCF methodology

The accounting models for credit impairment have received a big boost from the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB). The FASB has proposed the current expected credit loss (CECL) accounting standard to calculate expected credit losses in the US. The International Financial Reporting Standards (IFRS) 9 is IASB’s standard to estimate credit losses internationally. There are a few key differences between the CECL and IFRS 9 standards regarding their approach to calculating Estimated Credit Losses (ECL). One of the areas of difference is the model selection criteria. While CECL allows financial institutions to select the right measurement model to calculate the impairment allowance, the IFRS 9 standard prefers to use the Discounted Cash Flow (DCF) methodology. With the deadline for adoption of the CECL standard is inching closer for all financial institutions, US institutions need to pay special attention to the DCF methodology following an ever-increasing push towards harmonization between the CECL and IFRS 9 standards globally.

IFRS 9 offers few choices to institutions outside the US that are seeking to implement this accounting standard. Therefore, the accounting standard board, after thorough consideration, has decided that the DCF approach for calculating ECL is best suited for their needs and those institutions that fall under their jurisdiction.

Why the IFRS 9 prefers the DCF method

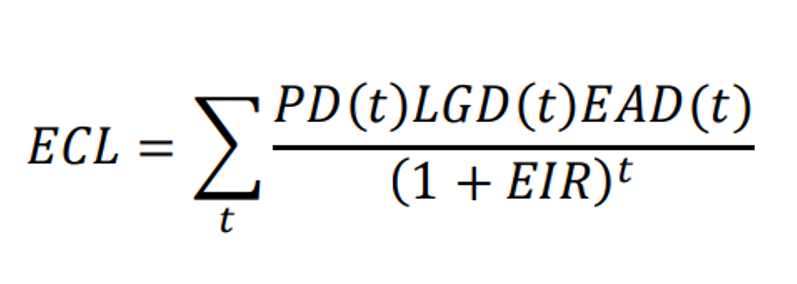

For IFRS 9, the ECL for a financial instrument is the difference between cash flows that are expected to be received and the contractual cash flows that are due. Given that the discounted cash flows approach to calculate ECL is preferred under IFRS 9. This calculation is shown below, and it uses discounted losses to provide the ECL value.

In the above calculation, future losses at time “t” are estimated using values such as:

- Probability of Default (PD)

- Exposure at default (EAD)

- Loss Given Default (LGD)

- Effective Interest Rate (EIR)

Understanding EIR

The interest the bank charges on a borrowed sum is known as the advertised interest rate or nominal interest rate. The effective interest rate reflects the actual cost of borrowing to the consumer and is normally higher than the advertised interest rate. The EIR includes amortization effects as well as components such as administrative charges or service fees for processing and approval of a loan. EIR is the effective interest rate for banks. It is also the value that they are really testing the risk on.

Core principles for using the DCF method:

- Loans are priced according to their Probability of Default (PD), so the profit banks make offsets the funding of any capital that they have to hold. Now, if banks have to hold capital, they effectively lose money through opportunity cost, because it is not in the market working for them. If they price the loan correctly and the system is working, then it triangulates properly.

- Not all banks refresh their PD all the time. If they do not, it does not work because one of the things they are supposed to capture is the deterioration of the PD itself. Therefore, if PD slips down and institutions do not capture it, they are constantly going to calculate the wrong number. Thus, it is important that institutions refresh their PDs.

- The other thing that is needed for the DCF calculation is the EIR. It is not the most complicated value to be calculated, but it needs to be done because of the methodology used within this calculation, which calls for banks to discount using the EIR. Therefore, they need to calculate the EIR.

Points to consider while using vendor services to implement CECL

- While selecting a vendor, institutions such as banks and credit unions need to ensure that vendors calculate the EIR. The only data they should ask for from financial institutions is the credit score. Vendors should also supply the curve that the credit score goes against, enabling them to determine the correct PD. If this can be managed, then the DCF method would probably be the best one to use because institutions will get the most accurate result. This approach will be the most accurate in keeping with the international version of this standard.

- Data such as the EIR and PD curves can be calculated or obtained from external sources, and therefore the vendor should supply it. The credit score belonging to clients of financial institutions is not accessible from the outside. Consequently, it is the institutions that need to refresh those credit scores and provide the data. The DCF method, if implemented correctly, can turn out to be the gold standard and bring the US banks in line with the international thinking for estimating credit loss reserves.

- When we see the formula for ECL, we can observe the losses and the EAD, but we are discounting that by the EIR because we are discounting that by what the bank actually charges. Their CECL solutions provider has to translate the credit score into a PD and calculate the EIR. Once the vendors calculate these values, they can provide them to financial institutions that have enlisted their services. If implemented successfully, the DCF method can be considered one of the most accurate ones. It is also an approach that every country will accept. This means that as standards harmonize over the years, which is a stated aim, we can rest assured that there is very little chance of this method being rejected. Alternate methods risk being ruled out during any such harmonization efforts.

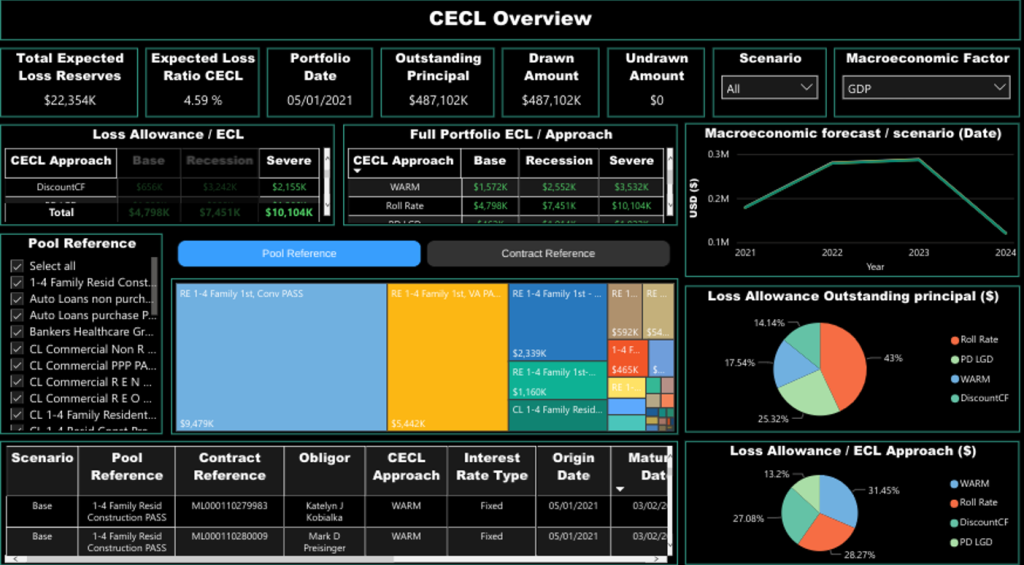

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.