CECL Implementation

After the financial crisis of 2008, it was widely agreed that it had been aggravated by the incurred loss methodology existing then, which delayed the recognition of credit losses. The Financial Accounting Standards Board (FASB) worked along with the International Accounting Standards Board (IASB) to come up with a forward-looking way of measuring credit losses. The FASB announced an Accounting Standards Update (ASU), now known as the Current Expected Credit Losses (CECL), to calculate expected credit losses, which are part of an institution’s financial assets. CECL facilitates the measurement and reporting of credit risk. Institutions will have to consider past events, prevailing conditions, and supportable and reasonable forecasts while estimating credit losses.

The deadline for implementing CECL is not far away. Some financial institutions have already implemented CECL, many are in the process of implementing it, and yet more are yet to start with their implementation process, and are currently looking at the best alternatives available to do it. There are a few basics that institutions have to keep in mind as they plan a road map for implementation. Some of these basics are explained below.

a) Model selection

The FASB has recommended several models under CECL to calculate reserves that would be needed to cover any future expected credit losses. Some of these models are listed below.

- Discounted cash flow analysis

- Loss-rate method

- Vintage analysis

- Probability-of-default method

- Roll-rate method

Financial institutions, according to their size, can scale CECL and apply it. Small institutions, in fact, are not required to apply any complex modeling techniques. While choosing a model, banks will need to use their judgment, keeping in mind the complexity and data capabilities of their organizations. It is necessary to use different models for different loan pools depending on the composition of a loan portfolio. A sophisticated model may occasionally be needed to predict upcoming losses. The institution’s existing strategy will work in other situations. The size of each loan pool, risk profile, and level of concentration, are just some factors that have to be considered before selecting the right approach. Each selection should be well-supported and documented, as this helps the organization explain its procedures during audits.

b) Data validation

Each CECL model requires data at every level of its operation, some of which are listed below:

- CECL requires advanced data validation, assessments, and interpretation, and it is imperative for organizations to ensure that they have the correct data for a successful implementation.

- Institutions need to determine and organize all available internal data that is required to successfully run their CECL models and come up with accurate reserve figures.

- In case of any shortage in internal data, historical or otherwise, banks can look at external data resources to bridge the gap.

- Data on the level of segmentation for loans that possess similar risk characteristics is needed.

- Data to support an institution’s forecasts and asset segmentation is required.

c) Solution design

The next step is to design the solution to suit models and data that is made available from institutions. Some firms have the requisite resources to build a CECL implementation solution themselves, while others must purchase it. Institutions need to be aware of the functions of the technology and software that are needed to support the model they select.

Banks can select solutions and options that range from sophisticated modeling software to internally developed spreadsheets. Larger and more complex institutions may find a third-party software product beneficial, while smaller institutions that choose simpler models may find a spreadsheet more suited to their needs.

d) Trial runs

After the solution design, institutions can commence the trial run. It is a stage when it is still possible to change anything if needed. Institutions should evaluate their internal capabilities to collect the required data and then run the CECL model to estimate future losses. This exercise helps them determine additional resources needed to fill any gaps in the system. One way to perform trial runs would be to develop certain model CECL scenarios and then run historical data through this model. The next step would be to compare the results to the expected performance.

e) Tweaking

After analyzing the results of the trial run, institutions can then tweak the solution and processes and tighten up everything to ensure it works seamlessly. Post this, the solution and models are locked into place.

f) Parallel run and going live

Once institutions have identified their models, performed trial runs, and made the necessary tweaks, they can move to parallel runs by testing and comparing the results of their tests to those of their current model. Depending on this analysis, they can adjust variables for the new model. As long as the parallel run is successful, the CECL implementation can go live.

Steps banks or credit unions can take when left with too little time to implement CECL.

When institutions are left with very little time to put a CECL solution into place, it will be very difficult to build something up themselves at the last moment. The steps involved in building and checking a solution and the requisite platform are time intensive. In this situation, institutions will need to think about taking some shortcuts.

The shortcut is that banks and credit unions use the solution from a third-party provider that has already got solutions up and running live. Why do they do that? Because it means that at least the important steps have been checked and verified by the provider. Hence, even though banks don’t have the time to get systems into place, at least they can say that multiple people have checked it, therefore it is likely to work. Institutions will still need to do some checking but it is much more feasible than building a solution from the bottom up.

So, with little time left, institutions need to find a third-party provider that can, first of all, make sure that it can map their portfolio. Financial institutions must have some idea in mind about the result they are expecting. Broadly speaking, it should be within 25 percent of their current result.

A third-party provider is someone who has gone through all the steps that are part of preparing for CECL implementation and has done it for several of its clients. Institutions should have an idea of their CECL results, and most importantly, they have to check if their CECL results can be audited. If they approached the entire process like an auditor rather than as an implementer, they would have ticked all the boxes that a bank examiner would be looking for while auditing their CECL results and systems.

Things financial institutions should avoid as they implement CECL

- Banks should not go with a solution that limits their model choices. It might seem like the quickest and easiest way with the time crunch on, but they might end up stuck with an inefficient model and possibly even a model that is not fit for their portfolio. They need to remember that in the future, their model requirement can change. This is particularly true if a vintage approach is selected because the correct vintage pools might not exist at some point in the future.

- Institutions should not get trapped into a contract that will cost them more in the future when it comes to adding additional models. It will be an open-ended spend at that point and will tax their resources. For banks, selecting a particular CECL solution might seem like a quick and easy fix, but if, to stay within the contract that they signed, they have to pay more to get what they need, it will end up being potentially expensive in the long run. Banks need to realize that they might not have much time at the moment, but they still have got a budget, and they need to know how that budget will play out in the next three years.

- Banks need to do their best to get a system that tells them more about their portfolio than just the CECL result. There are things within CECL, like stress testing, that also need to be considered. Institutions should think beyond the result as long as their chosen solutions give them options in the long run. In conclusion, banks need to try and get something that gives them more insights into their portfolio, more stress testing, and more capabilities in and around the possible scenarios.

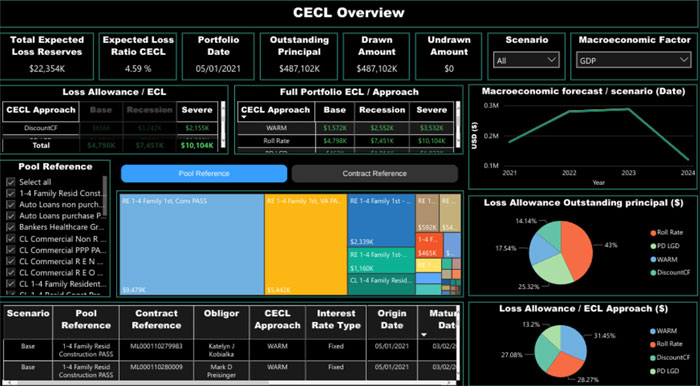

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.