CECL STANDARD AND THE BANKING INDUSTRY

Small community banks have until 2023 to implement Current Expected Credit Losses (CECL) accounting standards after the Financial Accounting Standards Board (FASB) decided to delay CECL implementation for private and small public companies in 2019. CECL implementation began for large Security and Exchange Commission (SEC) filers in January 2020. Preparing for CECL has been a challenge for even big banks with huge resources. Small community banks should utilize this additional time to prepare for CECL by accumulating the required data,

infrastructure, and resources.

Being proactive with timely sourcing of data under CECL

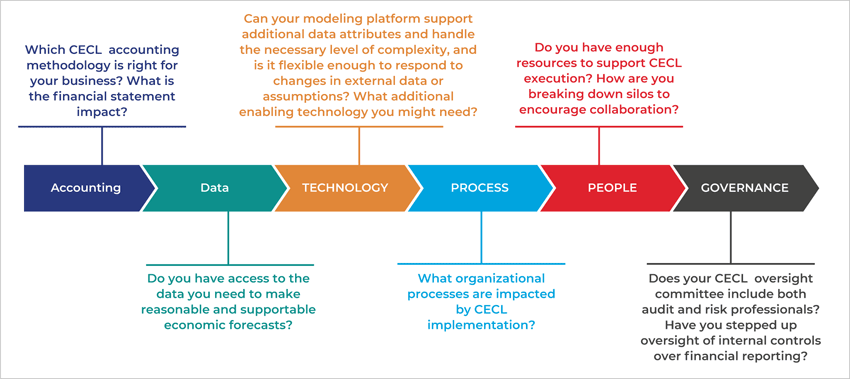

CECL requires community banks to calculate their allowance for Loan and Lease Losses (ALLL) by adding a forward-looking component and projecting future losses into the future, adjusting for historical loss experience. To implement CECL, banks will have to source the relevant data, build and test models, and then include the data in financial statement disclosures.

Small community banks—especially those with straightforward business models, limited loan loss experience, and less than $1 billion in assets—can, in all probability, depend on existing loss estimation techniques. They can demonstrate their readiness for the accounting change by using the additional time to prepare for forward loss estimation and also run parallel systems. The FASB hopes this additional time will offer relief to small banks with limited resources and give them time to learn from the implementation efforts of their larger peers. Since most small banks already have a good process in place, they should focus on improving that calculation for both quantitative and qualitative forward-looking factors. This involves gathering data for analysis and disclosure.

To estimate their allowance for credit losses, small community banks will need to attune their models to local conditions. For example, an agricultural bank will care more about crop prices than banks that serve suburban communities.

Community bankers will need to coordinate with their core providers regarding ways to pull data out of the system and test the results. One hurdle that community banks can face is that their core systems are not able to store a lot of data. This can limit the availability of historic data. There are some pertinent questions that small banks can face regarding the purchase and utilization of peer data. Questions that need to be answered include questions on what Q factors are applicable to specific loan portfolios and how some banks can deal with historically low loan losses.

Lessons from early adopters of CECL

Following the CECL implementation extension, community banks have had a chance to learn from the disclosures of big banks that were required to implement CECL in 2020. What is accepted as footnote disclosures under CECL is just one example of it. An increase in reserves has been observed among big banks that have implemented CECL. Some small community bankers have been pleasantly surprised to learn that much smaller adjustments to loss reserves are required using the CECL standard than what was previously anticipated. Regulators themselves are being proactive by asking community banks to be either ready with their CECL documentation or outline their plans on how they will adopt these changes, including asking them to reveal which method they plan to use to calculate reserves.

Data and CECL: Importance of reviewing data

- Segmentation: Consider what risk profiles are in your portfolio and then review your data to see if it can capture those risk profiles adequately. Also, review the frequency of missing values in important variables, their consistency in values, and their definitional consistency.

- Selection of Methodology: Review the historical data by checking if there is sufficient data to capture the behavior for a given risk profile, if the historical data is of good quality, and if there are gaps in the history.

- Granularity of Model: The granularity level a financial institution can use depends on the data. Review variables that are account specific, such as loan-to-value and credit score, and ensure that these variables are reliable. Check if these variables capture changes in customer or macroeconomic environment behavior.

The US Federal Reserve (FED) facilitates data and regulations for CECL implementation and calculations and also drafts changes that aid transition to the CECL standard. The roles of a couple of these federal entities are outlined below.

- Federal Financial Institutions Examination Council (FFIEC)

The interagency body of the U.S. government, the Federal Financial Institutions Examination Council (FFIEC) is made up of several U.S. financial regulatory agencies and was created on March 10, 1979. The objective of the FFIEC is to promote consistent and uniform standards for financial institutions. At the federal level, the FFIEC maintains uniformity in how financial institutions are regulated and develops standardized reporting systems. The FFIEC is the peer group data for all of the community banks. It provides a useful benchmark loss rate that can be substituted when the bank has too little data as a sample. When it comes to CECL implementation, reporting changes have been proposed to several Federal Financial Institutions Examination Council (FFIEC) report forms, including the Call Report. These instructions are available on the FFIEC Reporting Forms webpage. - Federal Reserve Economic Data (FRED)

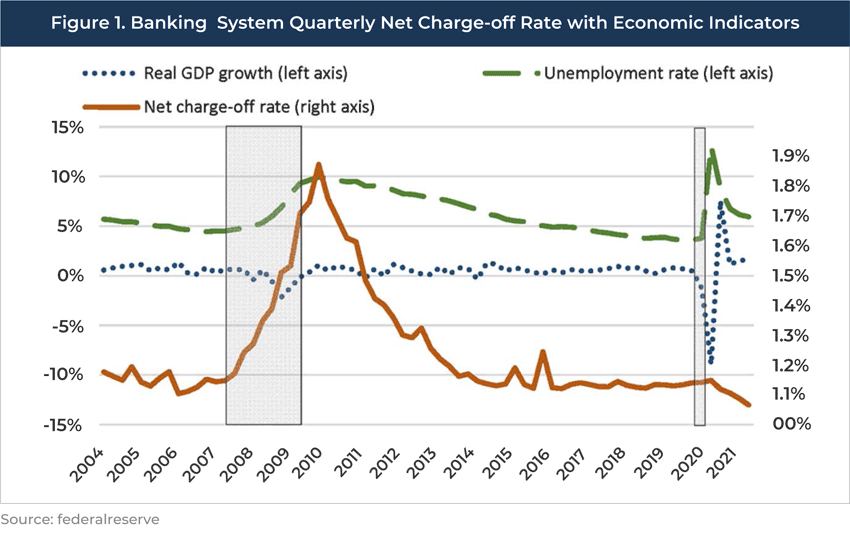

The Federal Reserve Economic Data (FRED) is a database that has almost 816,000 economic time series from several sources. It is maintained by the research division of the Federal Reserve Bank of St. Louis. It covers topics such as U.S. financial data, and U.S. trade and international transactions. This time series is compiled by the Federal Reserve, with data contributed by government agencies. The FRED is the macroeconomics source that drives scenarios used to calculate capital needed under the CECL standards. It was found that when unemployment increases and Gross Domestic Product (GDP) slows, there is an increase in loan losses (net charge-offs) as was evident during the 2007–09 financial crisis. Following the adoption of CECL, the US economy fell into a sharp decline due to disruption caused by the COVID-19 pandemic. This economic downturn was a test of the CECL methodology.

Data and regulations provided by federal entities such as the FRED and FFIEC are instrumental in helping banks implement CECL and thereby change their lending practices. CECL adopters’ allowances responded more quickly to fluctuations in the economic outlook than those of non-adopters.

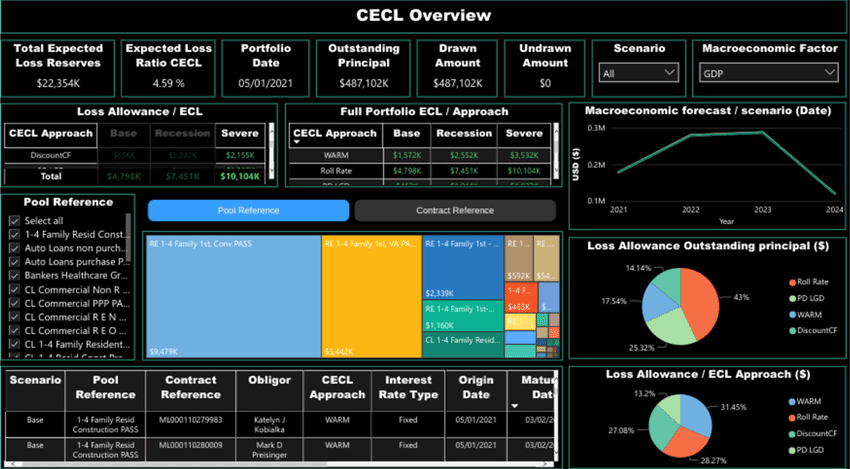

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.