AUDITING CECL RESERVE CALCULATIONS

The Financial Accounting Standards Board’s (FASB) new standard, the Current Expected Credit Loss (CECL) continues to be a challenge for independent auditors, financial statement preparers, and users. The metrics that companies traditionally used to estimate their future credit losses have undergone a paradigm shift with CECL. The previous method of loan loss estimation, using historical credit performance, has been replaced by CECL, which directs organizations to recognize an estimated loss provision during the loan’s lifetime, from the day of its origination.

The 2008 financial crisis highlighted the difficulty of financial institutions in estimating their actual expected credit loss provisions. This made investors lose confidence in the adequacy of Allowance for Loan and Lease Losses (ALLL) reserve balances reflected in the financial statements of those financial institutions.

Many lending products’ profitability will be negatively affected by CECL calculations. Significant challenges are also anticipated in auditing post-CECL reserve calculations, including getting assurance that overly subjective measures are not being used by management to manipulate earnings. The CECL standard does not explicitly direct institutions on how to factor in forward-looking information while determining their lifetime credit loss estimates. This allows diversity in how institutions choose to estimate credit losses.

A thorough CECL audit framework ensures that management at financial institutions is prepared to justify the data, assumptions, models, and adjustments used, as well as enforce requisite governance and controls.

Changes to CECL audit practices

Auditors can anticipate seeing a wide array of practices across institutions since CECL is a principles-based accounting standard. It is critical for auditors to interact frequently with organizations that are still adopting CECL. This will provide them with plenty of time to learn about management’s post-implementation processes and procedures. While implementation operations are ongoing, this approach can also ensure that the management has time to make necessary adjustments.

Economic conditions from the past are frequently poor predictors of future economic downturns. Forward-looking estimates are flawed and can be too late in reflecting signs of economic downturns, necessitating the management’s judgment-based modifications in ECL estimation processes. As a result, auditors will have the difficult task of determining whether the management’s depiction of financial statements is materially true. Since the management will be required to calibrate their models, they will need the liberty to make changes to their post-implementation ECL estimation models and techniques.

CECL is a complex requirement that needs a much broader set of assumptions and data that leads to more controls and documentation. All this preparation and anticipation will equip management at financial institutions to squarely tackle the audit and regulatory challenges. There are five principal areas that financial statement preparers need to focus on to defend their estimates while undergoing an audit. These areas are explained below.

Five main areas of focus for audit scrutiny:

- Data

Data preparers for a CECL audit must be accountable for all data used in the estimate and must create and implement an internal control mechanism to ensure that the data is comprehensive and accurate. Data that supports upstream processes must be well sourced and evaluated. To support an adequate assessment of the impact that each data factor has on the estimate, it is necessary to create an inventory of data elements. When employing external data, preparers are supposed to analyze to verify the data’s relevance and dependability.

- The usage of models

The management must focus on conceptual soundness, data and assumptions, calculations, and outcome analysis, just as auditors do. To ensure optimal model use, more advanced models necessitate proportionate managerial skills. Model validation is an important governance control for both initial adoption and ongoing model use. To use models efficiently, managers must understand and analyze historical model accuracy as well as model behaviors or patterns.

- Qualitative adjustments

The goal of qualitative adjustments is to resolve the quantitative approach’s flaws and limitations, as well as to assure that the CECL estimate as a whole meets the accounting and regulatory guidance standards. Assessing the qualitative adjustment requires sound logic and analysis of relevant facts. Management should create a risk inventory to assess whether a qualitative adjustment is required. A framework that is well-documented should establish a systematic and transparent approach for determining qualitative modifications.

- Assumptions

The management should also build an inventory of assumptions in order to recognize all assumptions. Auditors must be able to comprehend how management has determined the value of an assumption and why a particular one was chosen. Benchmarks should be assessed for relevance and consistency, as well as any discrepancies between benchmark numbers and internal data. Materiality is an important assumption in developing a CECL estimate, and the management’s records should show how materiality was taken into account. As new risks emerge, changes to the process may become essential.

- Controls/Governance

The control environment relies heavily on good documentation. Given the extra complexity and judgment required to produce a CECL assessment, a solid structure of governance is essential.

CECL is a more complicated requirement than prior standards, as it is based on a considerably broader range of data and assumptions, requiring more documentation and controls both during and after implementation. This article has outlined some of the major issues from the perspective of an auditor to assist preparers in better positioning themselves to substantiate their estimates when audited.

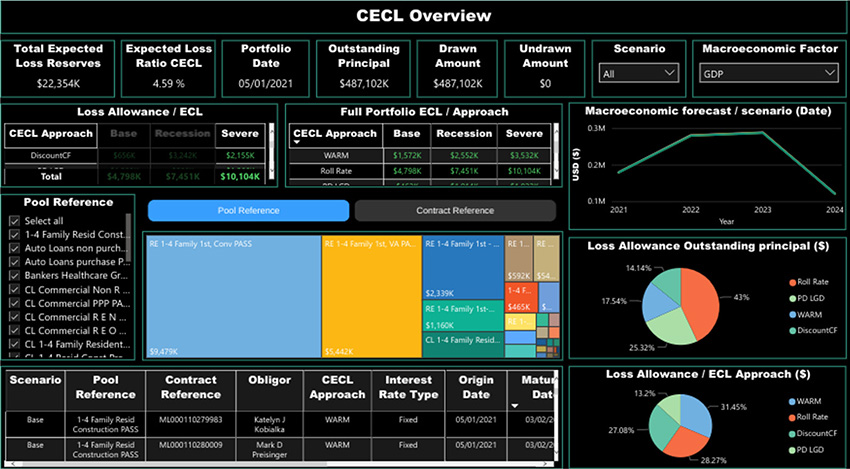

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.