CECL IMPLEMENTATION AND ASSOCIATED CHALLENGES

Implementing a new system and processes is never an easy task at any financial institution. to avoid disruption to ‘business as usual’, a rigorous approach must be taken. While this is true in all cases, CECL being implemented across the full spectrum of smaller ‘community’ banks and credit unions creates specific challenges of its own.

The reason that a CECL implementation is more complex for smaller banks is simply that it is asking banks to generate reportable, auditable results that use processes that are currently not part of the banks’ business model. This is because CECL not only looks at current impairment levels but asks financial institutions to predict future credit losses, using methods and techniques normally only found in larger firms. There are options in the specific methods that can be used, including:

- Weighted Average Remaining Maturity (WARM)

- Discounted Cashflows (DCF)

- Probability of default/Loss given default (PD/LDG)

- Roll Rate

- Vintage

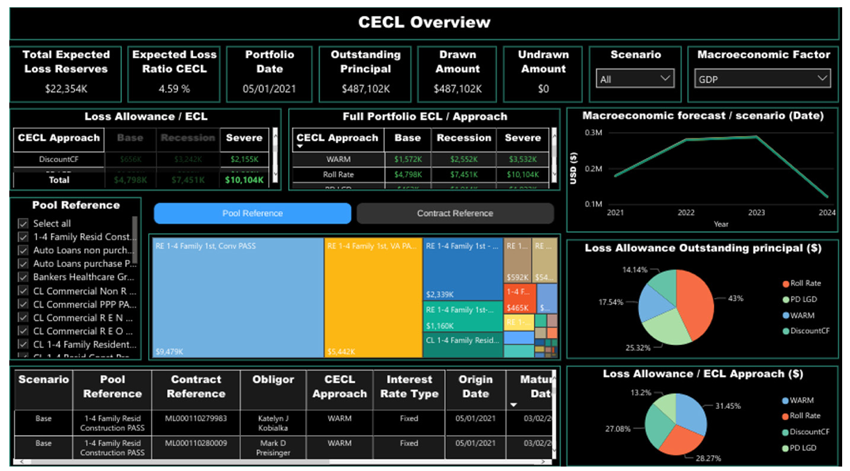

Each of these methods has nuances and consequences that have been covered in previous ‘insights’. FIs must be conscious that selecting a single method for expediency and compliance reasons could leave them with larger reserve requirements than their counterparts and at a distinct competitive disadvantage. By maintaining the possibility of using all methods as appropriate by loan pool, they can turn this into a positive competitive advantage.

The end game for a CECL implementation must include:

- Loan by loan auditability

- Full choice of methods by designated loan pool

- Capacity to drill down to Expected Credit Loss (ECL) inputs and computation

- Ease of use and ability to export for reporting

- Low need for secondary system developments such as data cleansing and ‘golden data’ storage

The problems arise in both the computational power needed to run all options and data availability to drive the calculations. From the perspective of having run multiple implementations of the CECL express system, a few of the ‘road bumps’ encountered are detailed herein.

Third-party data consistency

CECL takes, as a start point in most of the ECL methods, the current reported losses per pool. These can be accessed via the Federal Financial Institutions Examination Council’s (FFIEC) or National Credit Union Administration (NCUA) call reports. An issue that has been found is that programmatically building these links into a CECL program is far from simple. The call reports themselves do not guarantee to maintain the formatting consistency needed for automation.

- In 2022, the FFIEC report changed by a single line, throwing off many spreadsheet-based solutions. This inevitably means that data consistency becomes a manual job to be performed by the CECL preparation team using that format.

- The NCUA also changed the pooling for credit union peer groups, resulting in difficulty of comparing one period to another by pool, and potentially stranding assets out of calculable pools.

Such occurrences can be handled programmatically, with the correct error reporting and data management, but the key is that it has to be considered now, so as not to cause issues once the CECL system is an integral part of quarterly reporting.

Internal data availability

Some ECL models use internal data such as credit scores and ‘Loss Given Default’ ratios. These are used at loan origination but not always maintained as the loan runs through its life, especially when it shows little signs of becoming problematic.

This works for Allowances of Loan and Lease Losses (ALLL), but for CECL, poorly maintained LDG numbers or any failure to record credit deterioration can result in ECL numbers being far too high or low. This has been found to be the case in a few instances of GreenPoint’s implementation of CECL Express, and has been rectified by:

- Change in process for maintaining credit scores against obligors linked to the loans

- Defaulting missing values for values such as LGD on mortgage portfolios

- Exclusion of certain methods for specific pools due to lack of data

The above solutions are all valid but must be created explicitly when building the system. Attempts to use methods not supported by data within some loan pools may result in zeros finding their way, inappropriately, into the final computations, unnoticed by error checkers.

Lack of benchmarking

One of the most difficult issues is the lack of a benchmark to guide acceptance of the system’s output. Smaller financial institutions have not been required to run this type of analysis and, therefore, have just the ALLL to base expectancy on. This makes User Acceptance Testing (UAT) more difficult.

We do know that there should, all things being equal, be an increase in the provision following the introduction of CECL. Given that its aim is to bring in possible losses, even where none have been observed to date, this is inevitable. With that in mind, the following are useful steps to take:

- Select a small sample of loans

- Find the current known ALLL

- Compute the ECL for as many methods as possible, in as detailed and broken down way as possible

- Compare these and use this as the start benchmark increase

- Build out the system

- As pools of loans are added, monitor the benchmark that was created, looking especially for large deviations within a method

At this point, it is as much art as science, but as a rule of thumb from successful implementations of CECL Express, we have found that the range of increase should fall between 20% and 40% above the ALLL.

Lessons learned

In future pieces, we will discuss yield curves and economic data, but the above points are all live examples of what is found and how it is rectified during a standard implementation.

CECL is a journey into the unknown for banks and credit unions, using methods new to the bank, as well as data that may not be kept well or that is unfamiliar to the teams responsible for reporting the result. Success lies in rigor around data management, education on potential pitfalls, and monitoring expectations of the result. In the end, the ability to demonstrate attention to these details is just as important to creating a program that works and will continue to work as is compliance in January 2023.

CECLexpress.com can help in sourcing and maintaining all data required for five ECL methods and allowing banks to concentrate on just their Q-factors.

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.