TIME FOR CECL PARALLEL RUNS

Financial institutions across the U.S. have been planning for the Current Expected Credit Loss (CECL) accounting standard for several years now. There is a general agreement among financial circles that implementing the Financial The effective goal of a parallel run is to make sure that the institution is ready to review, calculate, and report on their CECL allowance for credit losses in 2023. This CECL result needs to satisfy the expectations of the management, external auditors, and regulators. Defining the objectives of the parallel run needs to be done early in the project planning phase. Accounting Standards Board’s (FASB) CECL standard will be a challenge, especially for small banks and credit unions. Financial markets have only a few months now to prepare for and go live with CECL.

Data preparation, loan pooling, and model validation are just some of the procedures that need to be put into place as we move to a forward-looking credit loss estimation standard. Considerable planning needs to be done before implementing any major change, and CECL is no different. Most institutions plan to execute a parallel run for the CECL process. Understanding the right way to do this will go a long way in laying the groundwork on which the structure of CECL can be built.

The guiding principles that should define a parallel run for institutions in 2022 are as given below:

- The ‘business as usual’ (BAU) process would run in tandem with the parallel run, and the resources needed for it have to be allocated accordingly

- It is best practice to have at least two complete parallel run cycles that include governance, financial reporting, investor communications, and the external auditor

- The parallel run and processes that surround it can be divided into the following stages:

- Stage 1 – Setting up a system

- Stage 2 – Refining and plugging data gapsa)

- Stage 3 – Initial results

- Stage 4 – Parallel run

- Stage 5 – Go Live

Data preparation and readiness are crucial aspects for each bank and credit union. Multiple models are used to calculate the required accounting provision under CECL, and each of them needs a comprehensive set of data to be used. Some examples of the data required are given below:

- External peer-group losses: The Federal Financial Institutions Examination Council (FFIEC) or the National Credit Union Administration (NCUA) can provide detailed information about peer group losses

- Bank losses: This would include any credit losses during the previous reporting periods

- Yield curves: Internal rate of return (IRR) is needed for calculating discounting cash flows, and relevant yield curves are used for these calculations

The idea is to work backward from the CECL ‘go live’ phase, and make important choices regarding the CECL solution set-up. Various data options must be assessed at this point, and a number of models are needed to be selected. The requirement for each need to be understood, including:

- Computation requirements

- Data identification, cleansing, and storage

- Model audit needs

After this stage, such reporting needs to be developed that can provide enough information to a bank audit team to show that Expected Credit Loss (ECL) calculations are based on relevant inputs and methods. This should be properly analyzed and must include:

- Macro-economic scenario factors

- Market data and credit loss curves

- Obligor behavior scenarios (pre-payment speeds)

- Peer group losses

- Qualitative adjustments to reflect local factors

At this stage, the checking and audit reports need to be developed, and the final reporting can be perfected when the time to ‘go live’ comes closer. Before the first parallel run of the system can start, the entire process needs to be tested end-to-end.

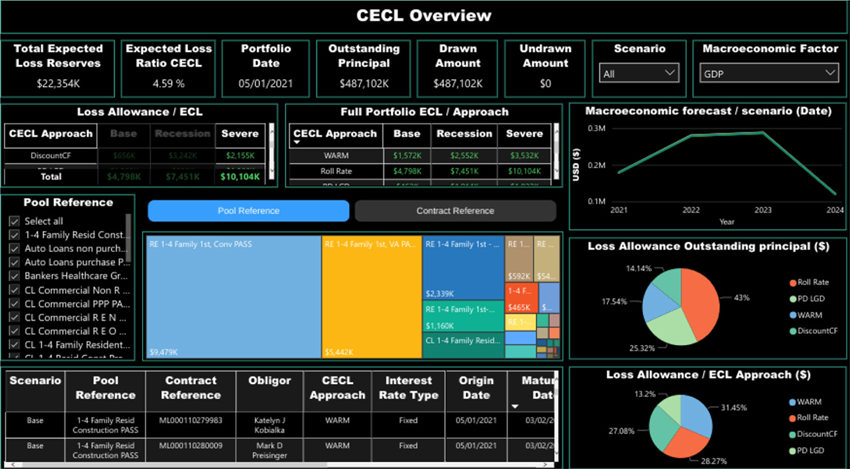

A ‘full dress’ parallel run at this stage will ensure a smooth transition to the new standard. This will fix the remaining issues and test any new systems alongside the Allowances for Loan and Lease Losses (ALLL) processes that are established. This part of the process is crucial as it has to be a parallel run with no significant changes. This ensures that the CECL results that would be needed in 2023 would be as required. The ECL models will have to be put into place by now. CECL results will then have to be planned in a way that they can be defended during audits. To prepare for audits, reports and dashboards need to be created that allow auditors to:

- See the results by pool

- Analyze the data that has contributed to these results

- View the overall result at a granular level (loan by loan)

The final stage is where the parallel run is executed in which the system needs to operate as if it were live. It has to provide meaningful results without too much intervention. For financial institutions, being prepared by executing a comprehensive parallel run process in 2022 should be well worth the effort.

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.