HISTORICAL DATA AND CECL

Most financial institutions have, by now, developed a Current Expected Credit Losses (CECL) implementation plan. If any institution is lacking a comprehensive historical data set, they need to start focusing on gathering data in order to use bottom-up historical loss data effectively in the future. Relevant historical loss data helps

The importance of relevant historical data to banks and financial institutions for implementing and monitoring the CECL framework is explained below:

- Once organizations have the required historical data in place to calculate CECL results, they have to then focus on maintaining, documenting, and storing all this data for audit analysis and internal review purposes

- A loan portfolio’s profitability and risk over the life of a loan needs to be originated, maintained, and monitored by using clean, relevant, data

- As organizations try to implement and comply with CECL, they may struggle to defend their CECL models and results in front of auditors due to a lack of relevant historical data

- Every piece of data that goes into a CECL calculation needs to be stored historically

- As best practice, institutions should start comparing their CECL results between reporting periods to identify issues within loan portfolios.

- Issues within the loan portfolios can only be identified if the right data has been stored so that, during audits, auditors can explore a particular loan pool or specific loan

- Lenders should consider data over the full lifecycle of the loan, and then leverage as much of the information as their systems will allow

- The portfolio of loans needs to be continually monitored throughout its life cycle by using relevant data to ensure profitability

- Lending institutions that are more data-driven are more successful in navigating CECL

- Lenders such as banks can be more profitable by pricing their loans accurately at origination using the same information needed to comply with CECL

- A comprehensive data history of the loan is required to estimate the full cost of a loan at origination

Besides the above points, several other factors come into play post CECL implementation that would affect credit within a portfolio. If there is enough data, then banks are able to price the loan accurately. For example, for a residential mortgage portfolio, even after origination, institutions need to periodically monitor loan rate determinants such as:

- FICO score validity

- Loan-to-value (LTV) data

- Debt to income (DTI) data

- Past due status

- Payment history and ability to pay in the future

The importance of the above determinants became all too clear for the residential mortgage

market during the 2008 financial crisis. That is one of the prime reasons why, through CECL, institutions should compare loan data of every reporting period to understand any major fluctuations that could turn out to be detrimental to their portfolio in the long run. Other than the points listed above, there are other factors of importance to a credit officer such as:

- Occupancy

- Purpose Occupation

- Location of the property, and

- Cash reserves at closing

Any fluctuations in the above data points, if ignored, could dramatically alter the CECL reserve calculations and affect the ability of an institution to channel capital to the markets, thereby affecting profit margins.

Each loan deal follows its own unique pattern of negotiation between the borrower and the lender. These lending deals are based on several data factors, such as:

- Size of the deal

- Client history

- If the borrower has other loans with the lender

- Deposits made by the borrower

- Property location and property type

When a framework is put into place by banks to compare and analyze data for each reporting period, it becomes that much easier for them to spot risks and avoid capital loss. The soundness and safety of a financial institution are ensured when they get into the practice of regularly evaluating the credit of their portfolio using well-sourced and well-researched historical data.

CECL Express can help…

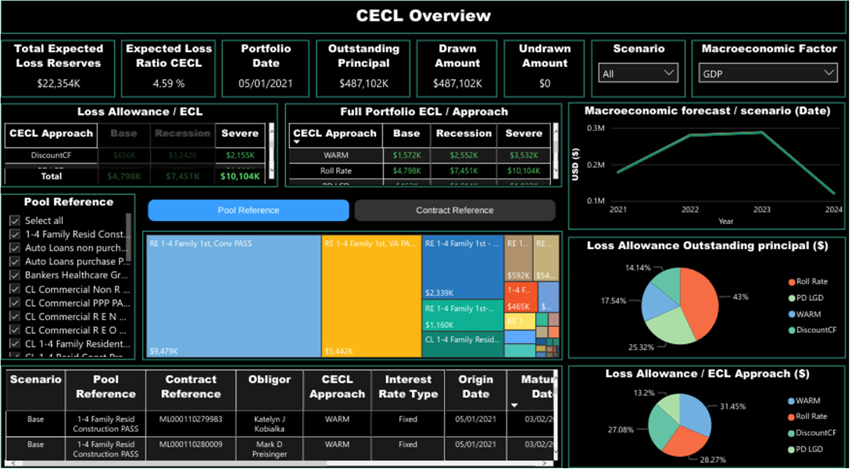

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.