CECL IMPLEMENTATION DURING THE PANDEMIC

The Financial Accounting Standards Board’s (FASB) accounting standard, Current Expected Credit Losses (CECL), is one of the more challenging accounting change projects that financial institutions, such as banks, may have witnessed in the past decade. Recent events such as the COVID-19 pandemic have added another layer of challenge to an already stressful economic scenario. Using the new CECL standard to calculate and forecast expected credit losses during a pandemic is not an easy task. Selecting the best CECL model to determine expected losses over the life cycle of loans and cash flow projections are just a few challenges institutions will face as they look to implement CECL.

As the Allowance for Loan and Lease Losses (ALLL) accounting standard gets replaced by CECL, financial institutions will have to put methods and systems in place to ascertain the expected losses over the life of loans and will have to abandon the ALLL method, which relies on incurred losses. The financial crisis of 2007-2008 highlighted shortcomings of the ALLL accounting standard, and the present pandemic shows us exactly why the FASB wants most financial entities dealing in credit issuance to come onboard the CECL methodology as early as possible.

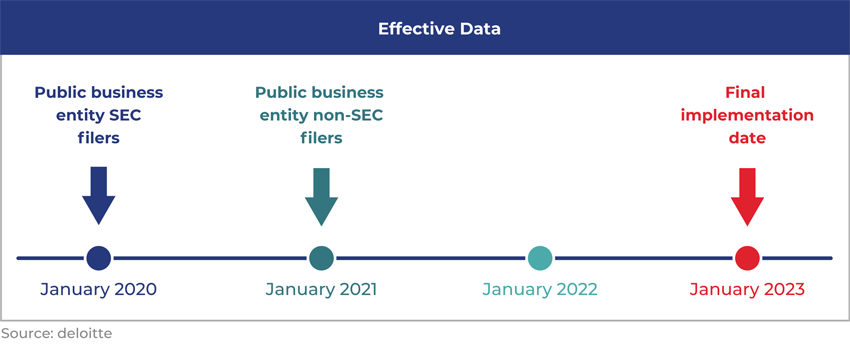

CECL’s journey and timelines since June 2016 Since introducing the CECL in June 2016, the FASB has published its Accounting Standards Update (ASU). The FASB has laid out a flexible timeline for financial institutions to comply with the new accounting standard and effective dates for CECL change with the institution type. For example, January 2020 was the start date for the accounting standard for public business entities that are US SEC filers. It will come into effect for credit unions and all other lenders by January 2023. Although the US CECL standards differ from the International Financial Reporting Standard – IFRS 9, introduced two years earlier, they do align fundamentally in their requirement to calculate expected credit loss over the life cycle of a loan. The older method’s limitations, when it came to the calculation of potential future losses and underrepresenting impairments, seem to have been rectified with CECL.

CECL implementation dates

The significance and impact of CECL

Initial filers of FASB’s CECL standards have disclosed higher loss reserve levels, with variations existing across reporting banks. The increased credit loss provisions will invariably impact these banks’ balance sheets and will have a domino effect through future stress tests.

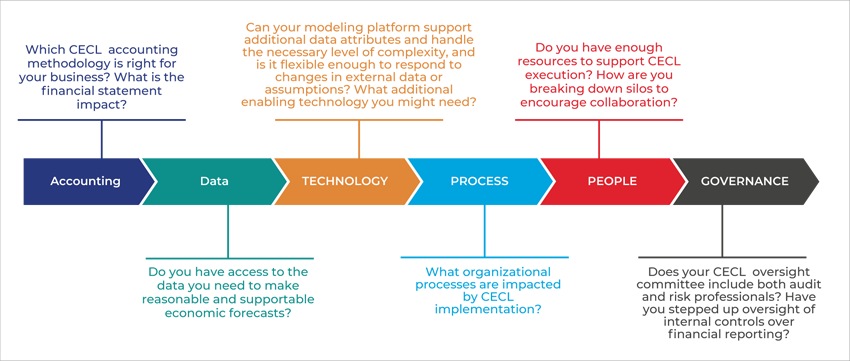

CECL will also affect how institutions handle their ALLL and organizational processes for risk and finance management. A deeper level of loss modeling and analysis is needed to implement CECL. The complexity of a balance sheet will determine how substantial these changes will be. Financial institutions will need to become more efficient while sharing information between departments and managing risk and financial data as they look to comply with CECL.

CECL and its associated challenges

The CECL stipulation to move to an expected credit loss accounting framework from that of an incurred loss one comes with its own unique set of challenges.

- The previous standard required an allowance for credit losses that were expected to be incurred over the next 12 months. CECL now requires a lifetime credit loss allowance to be set right at the beginning of each exposure. It also changes the way purchased credits and assets held for sale are treated.

- CECL needs more complete and detailed data to complement its expected credit loss models, which are more complex. It adds granularity to the process of maintaining historical data on credit losses. It also works out the impact of various scenarios on credit losses by analyzing macro-level data and risk factors.

- The level of disclosures has increased substantially under CECL. This means more transparency around the overall process that led to specific levels of loss reserves. Disclosures that allocate reserves by origination date will also increase. An efficient system that captures and governs the process from start to finish becomes important given the need to constantly defend assumptions and choose a methodology.

CECL and the banking industry

CECL will have several operational implications for the banking industry, including operations such as accounting/finance, risk, and IT. It will also have a financial impact on capital ratios and impairment estimates. The banking industry can avoid the pitfalls of falling behind on resource planning and critical deadlines by planning for CECL strategically. Selecting the right CECL methods and focusing on areas such as business impact, data management, risk, and technology will help banks to stay on top of the CECL implementation curve.

Final thoughts on how to get CECL to work for you

- Institutions should focus on designing systems and processes that do not overwhelm their existing manpower.

- Financial institutions will have to work around and modify their current allowance and other regulatory and business processes to deliver a more integrated solution capable of implementing CECL. This follows a realization that several aspects of the allowance process are already in use for stress testing and capital planning functions.

- Financial institutions need to account for the contribution of losses from all loans under the CECL standard as against contribution from only a subset of loans in the previous standard. This makes CECL a more computationally intensive process than the current incurred credit loss method. This means that institutions will have to ramp up efficiency of their model execution platforms.

- Lenders who seek the maximum application of CECL for their firms need to focus on the right architecture and adaptable framework, solutions that are modular with an open design approach, and also systems and processes that support iterative development cycles.

By now, most financial institutions should be well along on the path to implementing CECL. Firms that are aiming to be CECL compliant by 2023 will want to design and implement internal controls, run use-case scenarios, and start drafting disclosures. These steps will ensure a smoother and more timely transition to CECL.

CECL Express can help…

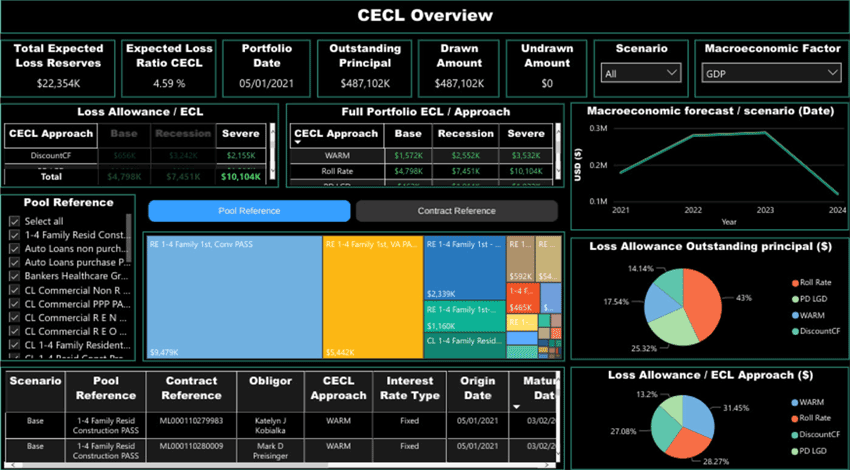

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC

- and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.