OVERVIEW OF THE PROBABILITY- OF-DEFAULT/ LOSS GIVEN DEFAULT METHOD

The Financial Accounting Standards Board (FASB) is flexible when it comes to choosing the applicable methodology for implementing the Current Expected Credit Losses (CECL) standard. It can be a challenge for financial institutions to choose the right method to determine their allowances for credit losses as some of these seem overly simple and some are too complex. The Probability-of-default/ Loss Given Default (PD/LGD) method is one of the simpler methods to understand, and is explained in detail below.

How does the PD/LGD method works?

In concept, the PD/LGD methodology is relatively simple. The challenge financial institutions will face when using this PD/LGD methodology is the calculation of the three inputs needed to estimate lifetime losses.

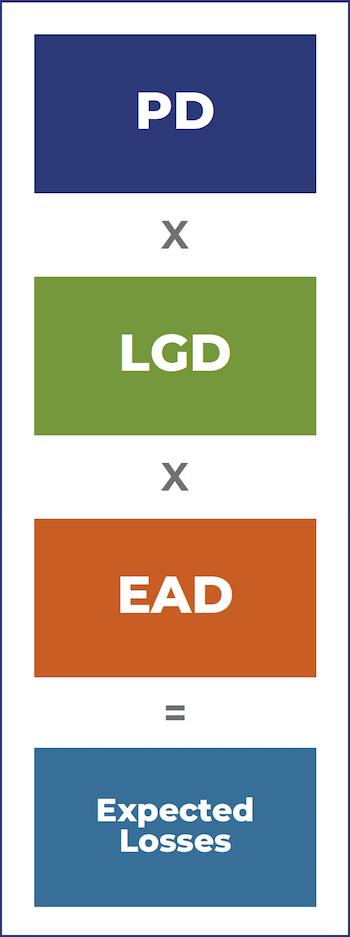

The three variables needed to calculate the PD/LGD methodology are discussed below:

- Probability-of-default (PD): After defining a default, a financial institution must calculate the likelihood of a loan in the pool defaulting. They can do this in the beginning, based on the historical performance of the pool. The Probability-of-default can then be adjusted for forecasted and/or current changes in the economic environment.

- Exposure (E): The exposure at default is the value of the balance of the loan that will be due when it defaults.

- Loss Given Default rate (LGD): The LGD is depicted as a percentage of total exposure at the time of default and is the money a bank or similar financial institution loses whenever a borrower defaults on a loan. A financial institution uses cumulative losses and exposure after a review of all outstanding loans, to calculate its total LGD. The institution’s loss given default rate can be adjusted for current and/or economic changes.

Financial institutions will need to perform some statistical analysis of historical information to estimate the above variables. The expected lifetime loss is then determined by multiplying these variables together: LGD x PD x E. These three variables will be adjusted for forecasted and current changes individually.

Example:

If the LGD = 20%, PD = 7% and E = $1 million

The expected lifetime loss under the PD/LGD method is 20% x 7% x $1 million = $14,000.

Advantages of the PD/LGD method: The fact that the Probability-of-default method relies on more quantitative information makes it accurate and gives it an intuitive edge over other methods. Qualitative factors, based on historical data, can be reflected in the model instead of being added to the quantitative part, as is the case with other methods.

Disadvantages of the PD/LGD method: To accurately determine the three inputs to the model, an institution will need more data, which will result in additional work. More data will be needed to understand how economic factors affect the variables. Only then can these variables be adjusted for current and forecasted changes. There will be a need for specialized software to perform statistical analysis for these calculations.

Conclusion As discussed, the PD/LGD method uses more quantitative information and relies less on subjective analysis. This allows the methodology to provide a CECL compliance allowance for credit losses.

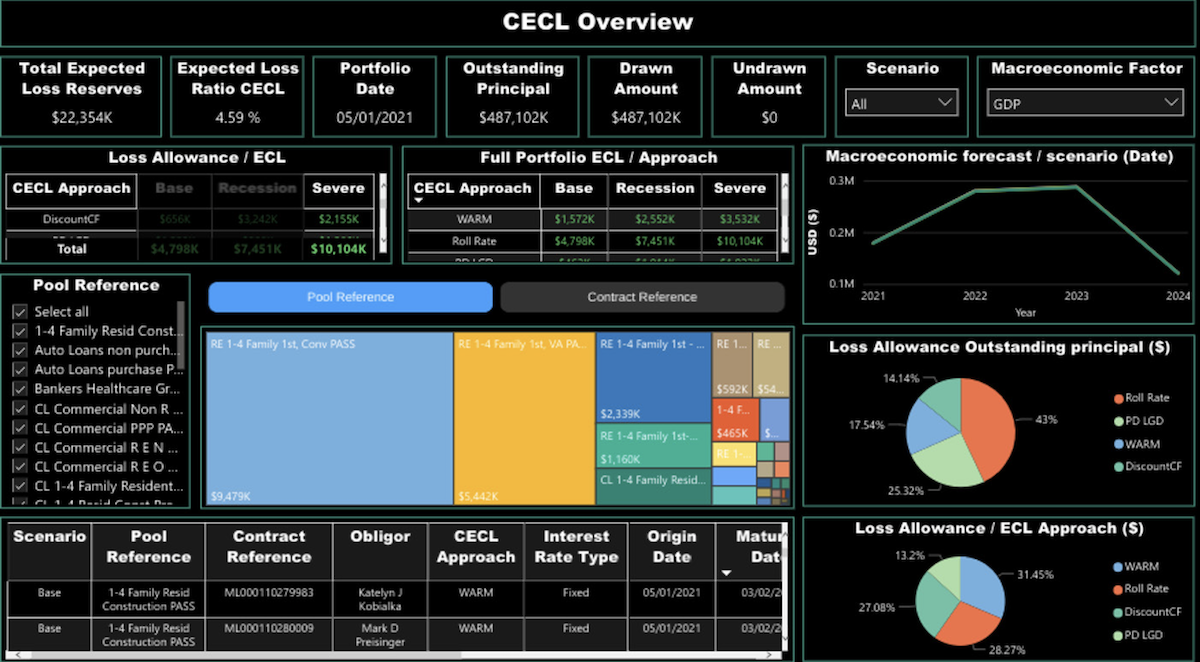

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.