CECL THROUGH WEIGHTED- AVERAGE REMAINING MATURITY METHOD AND DISCOUNTED CASH FLOW ANALYSIS

The Current Expected Credit Losses (CECL) standard was issued by the Financial Accounting Standards Board (FASB) on June 16, 2016. The CECL methodology replaced the longstanding Allowance for Loan and Lease Losses (ALLL) accounting standard for computing allowances for credit losses on a timely basis. In this article, we focus on the two CECL methods – the Weighted-Average Remaining Maturity method and the Discounted Cash Flow Analysis. We evaluate their unique strengths and limitations and the financial institutions they are best suited to.

Weighted Average Remaining Maturity method: One of the newest methods, the Weighted-Average Remaining Maturity (WARM) method, is best suited for institutions with less loan-level data. Institutions are able to use aggregated data from call reports since the WARM method uses an average annual charge-off rate. The WARM method is forward-looking. It requires less data when compared to other methodologies. This benefits institutions that use pool-level data as they lack the availability of granular loan-level data.

As mentioned, in order to estimate the allowance for credit losses (ACL), the WARM method uses average annual charge-off rates along with remaining asset lives. Institutions have to estimate an annual charge-off rate for every pool of assets that have a similar risk. This calculation can be compared to the historical loss calculations being utilized currently by many institutions. The historical loss period that is used needs to be representative of the financial institution’s most-suited business cycle for every pool of assets.

The WARM method then calculates the unadjusted historical charge-off rate, by multiplying the historical loss rate with the weighted average remaining life of the assets. After adjusting the unadjusted historical charge-off rate for the remaining balance with qualitative factors, the result is applied to the period ending balance to arrive at the required ACL.

This model takes into account projected prepayments to incorporate the expected average life of each pool of loans. This is the primary difference between the WARM method and the traditional ALLL model. The institutions have been advised by regulators to calculate estimated pay down rates after looking at their asset/liability management programs and external data.

Institutions with evenly distributed loss rates may find this method ideal. In order to support the WARM method, institutions with complex portfolios would need to be more reliant on qualitative factors and forecasts. They also need to ensure that all qualitative adjustments and forecasts are reasonable and can be supported. Regulators, though, opine that the WARM model, though practical, is not essentially the preferred methodology for institutions.

The institutions and segments best-placed to take advantage of the WARM method are:

- Portfolio segments, which have data limitations that are both operational and numerical in nature

- Complex portfolios or segments that find the WARM method more applicable to them

- A financial institution with a new line of business that finds the WARM method more applicable

Discounted Cash Flow Analysis: Under CECL, there is a change to the Discounted Cash Flow Analysis method with a requirement to consider at least some risk of loss and removal of the best estimate notion. This method now incorporates relevant external factors that indicate a credit loss that is expected. Consequently, new data might have to be developed, especially for individual assets, to support the cash flow expectations.

A financial institution, while following a discounted cash flow calculation, must estimate the cash flows to be received over the life of a loan in a pool. Expected forecasts and historical data are part of the inputs required for discounted cash flow calculation. The variables required for this calculation include:

- Payment amount

- Maturity date or remaining term to maturity

- Prepayment speed

- Internal Interest Rate (IRR)

- Loss given default rate

- Discount rate

Considerations of the Discounted Cash Flow Analysis:

Considerable historical data and analysis may be required while trying to obtain these variables from an institution’s loan system. To calculate current and forecasted changes, a financial institution can input this data directly into the model.

More computing power would be needed for institutions that want to use this methodology. This is because of the calculations that are needed to schedule out each loan’s estimated cash flows and discounting those cash flows. The discounted cash flow methodology uses a number of quantitative inputs, making it one of the most precise CECL methodologies. These variables can be adjusted for current as well as forecasted conditions. Estimated future losses are discounted to present value using this method, resulting only in the smallest estimate of credit losses.

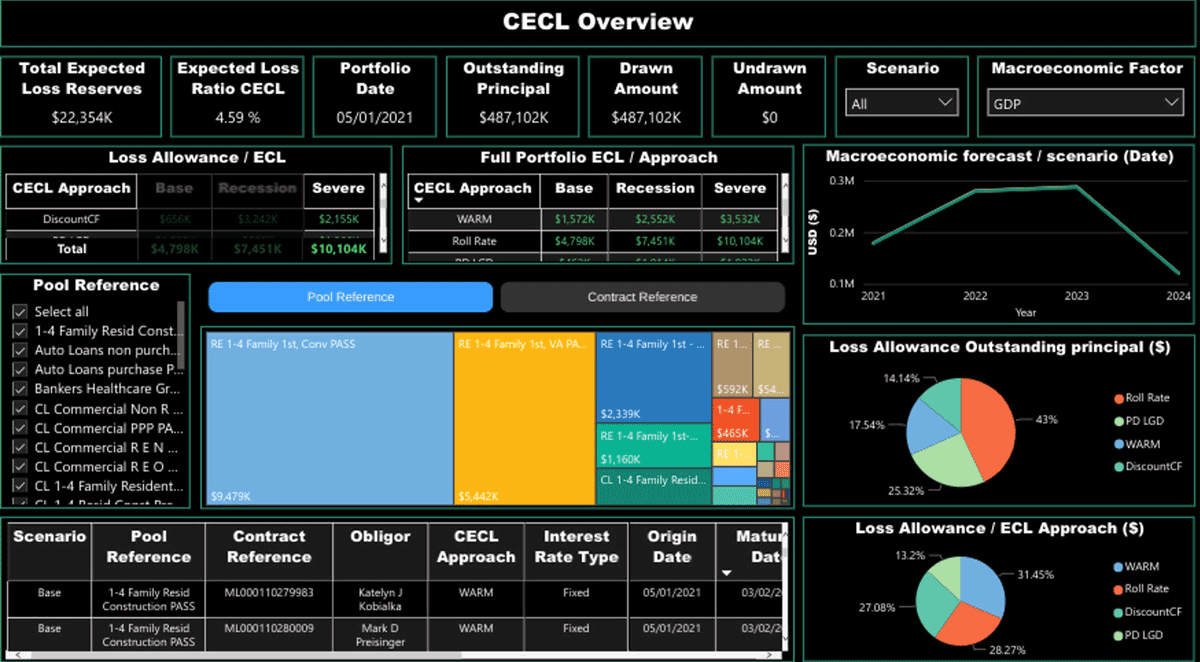

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC

- and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.