ESTIMATING CECL USING VINTAGE AND ROLL-RATE METHODS

Post the 2007-2008 financial crisis, the Allowance for Loan and Lease Losses (ALLL) method proved inadequate for the adjustment of reserve levels of financial institutions. It caused a massive wave of credit losses for banks. To rectify this situation, on June 16, 2016, the Financial Accounting Standards Board (FASB) formulated the Current Expected Credit Loss (CECL) to replace the ALLL standard. The CECL standard was designed to anticipate, and reserve against losses in a timely manner.

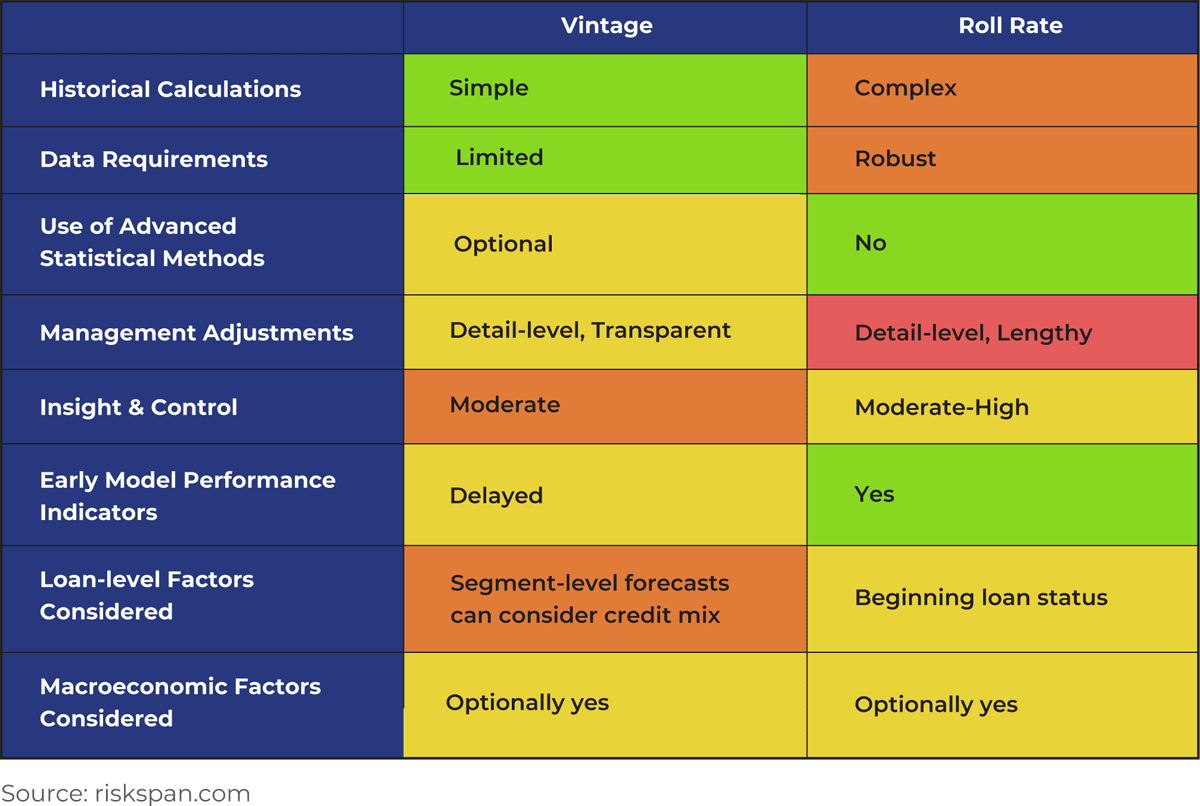

Under the CECL umbrella, the Vintage and the Roll-rate methods give us some of the best estimates when determining the expected credit loss model. Both these methods are detailed below:

Vintage Analysis: Vintage analysis draws its data from loss curves. Loss curves incorporate expectations of losses at every point in the life of a financial asset. The main change to the vintage analysis method under CECL is that the allowance will be reflected by the remaining area under the loss curve (which is the expected credit losses on the remaining life of the asset) instead of being reflected by a point on the loss curve.

The Vintage Methodology measures the expected loss calculation for future periods based on historical performance of loans with similar risk characteristics and life cycles. For this methodology, it is preferable to consider similar loans that follow comparable loss curves.

Under CECL, the Vintage Methodology measures the expected loss calculation for

future periods. This is based on historical performance by the origination period of loans with similar life cycles and risk characteristics. It is advantageous to pool similar loans. These loans create loss experience curves that can be seen predictive for future periods. To execute Vintage Methodology, some data elements must be included. Some of them are loan balance, loan number, maturity date, balance at origination, and renewal date. Implementation would include:

- Beginning with historical loss rates for each vintage.

- Analyzing the trends in recent vintage loss rates.

- Filling in the loss rates for future periods based upon historical trends.

- Considering changes to present conditions, and reasonable and supportable forecast periods.

- Separating adjustment factors that may be required for each vintage depending on the differences in their makeup.

- Depending on forecasted conditions, these adjustments could either be negative or positive.

When it is noticed that future years are no longer forecastable, it is advised to go back to adjusted historical averages. Adjustment or Qualitative (Q) factors need to be re-evaluated as economic landscapes shift.

Isolate and then apply the expected loss rates determined from the historical loss rates to the balance of each vintage pool as of the reporting date, to determine the Allowance for Credit Losses (ACL). The totals for each vintage are added to find out the current expected loss.

Credit portfolios, indirect auto loans, and other consumer loans work well with the Vintage model.

Roll-rate Method (Migration Analysis): Roll-rate models based on risk ratings require regular and timely updates to credit risk ratings for all assets. Consequently, this model might not be the best predictive measure. With this method a financial institution will need to ascertain the primary attributes that predict loss most appropriately.

Various economic cycles are reflected by assembling default or loss migrations. These default migrations are tested through those cycles to assess the reliability of the model. To improve precision, limitations on time series length, population sizes, and data integrity may need to be combined with judgments and additionally calibrated over time.

Institutions will take time to make these final determinations before opting to implement such a methodology. Below are the several pros and cons to be considered before banks and financial institutions consider the Roll-rate method for implementing CECL.

Pros:

- Estimation based on this method is more accurate. This is done through granular analysis since an individual account’s loan tracking is done over a period of time to assess its performance.

- Roll-rate method considers macroeconomic conditions or defaults while accommodating expected changes to transition rates.

- When used with a separate probability of default method, the roll rate method generates a joint probability of loan migration from one bucket to another.

Cons:

- Since the movement of segments over time is modelled at a granular level, a large quantity of data is required.

- The Roll-rate method’s performance is vastly impacted by the starting point of analysis.

- Beyond the near term, it is found that this method has weak predictive power.

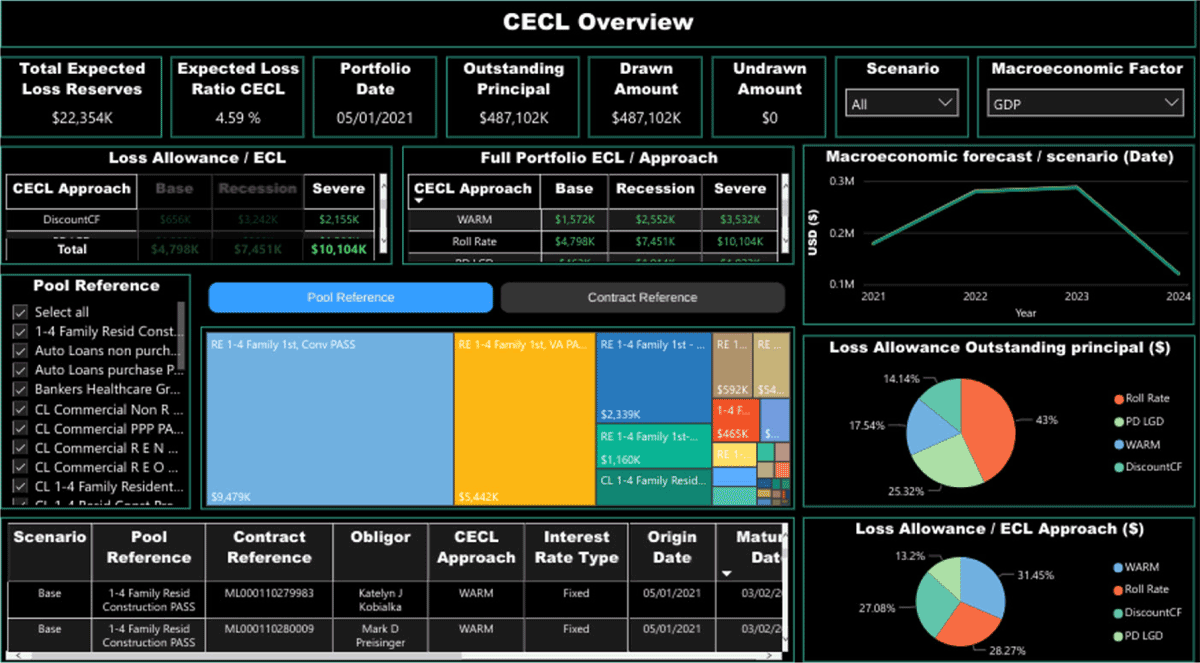

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.