THE CECL METHODOLOGIES

The Current Expected Credit Losses (CECL) methodology for estimating allowances for credit losses came into existence on June 16, 2016, and was issued by the Financial Accounting Standards Board (FASB). CECL replaced the Allowance for Loan and Lease Losses (ALLL) accounting standard. ALLL relied on losses that were incurred but did not factor in future cash flows that would end up uncollected. The 2007-2008 financial crisis demonstrated the inadequacy of existing methods for setting reserve levels that reflected expectations of future market conditions.

The CECL standard will incorporate a change to the allowance methodology by asking financial institutions to move to an expected credit loss model, which is a lifetime estimate. Financial institutions such as banks will have to make this shift from the longstanding incurred loss model. This shift will force these institutions to develop estimates that are forward-looking in nature.

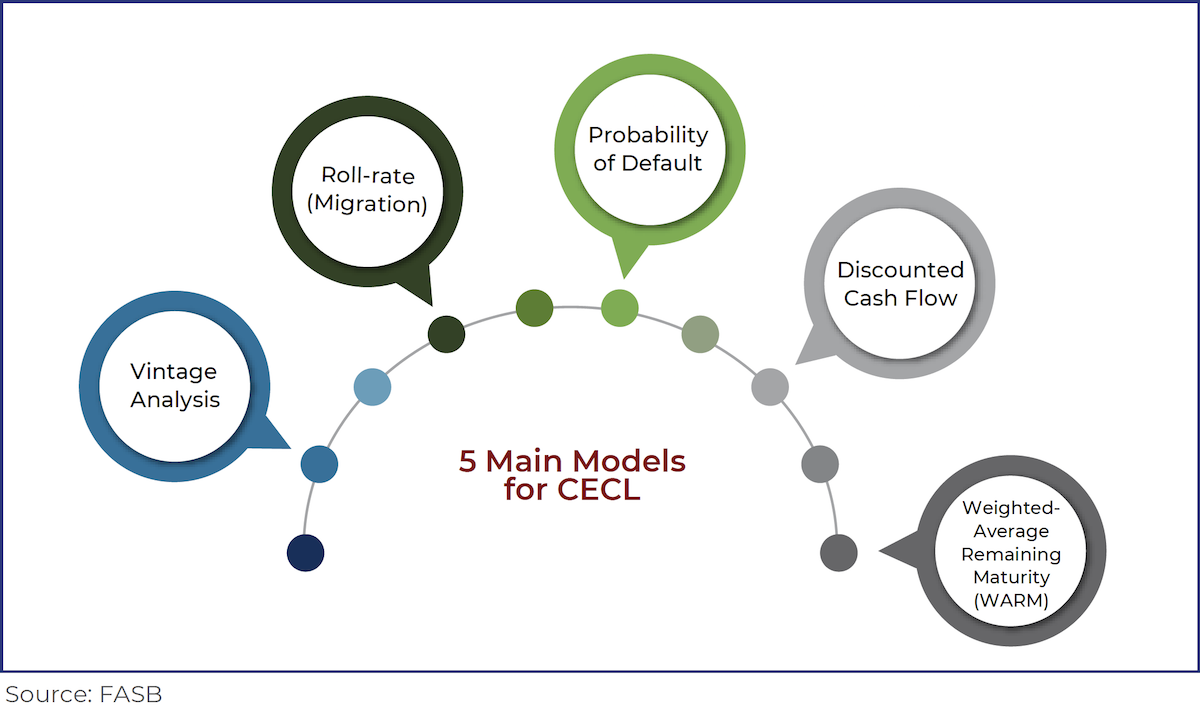

Entities will also need to consider being subject to internal control audits as they plan their shift to CECL. FASB did not include absolute limitations on the methods and models institutions could use when implementing CECL. Several models have risen in popularity within financial institutions, to estimate expected credit losses. Different models can be used for different asset types. The data collection and storage processes, needed to implement CECL, will undergo fundamental changes.

Below, we provide an overview of some of the main models that are used as part of CECL

- Discounted Cash Flow Analysis:

Under CECL, there is a change to the Discounted Cash Flow Analysis method with a requirement to consider at least some risk of loss and removal of the best estimate notion. This method now incorporates relevant external factors that indicate a credit loss that is expected. Consequently, new data may have to be sourced, especially for individual assets, to support the cash flow expectations.

- Vintage Analysis:

Vintage analysis draws its data from loss curves. Loss curves incorporate expectations of losses at every point in the life of a financial asset. The main change to the vintage analysis method under CECL is that the allowance will be reflected in the remaining area under the loss curve (which is the expected credit losses on the remaining life of an asset) instead of being reflected by a single point on the loss curve.

- Roll-rate Method (Migration Analysis):

Roll-rate models based on risk ratings require regular and timely updates to credit risk ratings for all assets. As part of the roll-rate method, a financial institution will have to ascertain the primary attributes that predict loss most appropriately. Various economic cycles are reflected by assembling default or loss migrations. To improve precision, limitations on time series length, population sizes, and data integrity may need to be combined with judgments, and additionally calibrated over time.

- Probability-of-default method:

Institutions opting for a probability-of-default will have to check the reliability and accessibility of historical data sets. These data sets may be used to build the cumulative default probabilities and loss given default. A standard definition of default and paths to default that could occur within a product line will need to be assessed by the institution. To supplement the institution’s own experience, various industry sources of data could be utilized to evaluate the probabilities of default over different economic cycles.

- Weighted-Average Remaining Maturity method:

One of the newest methods, the Weighted-Average Remaining Maturity (WARM) method, is a practical methodology to implement CECL. For institutions with less loan-level data, the WARM method is a good option. Institutions are able to use aggregated data from call reports since the WARM method uses an average annual charge-off rate.

Financial institutions can choose from these methods to comply with the CECL model. With adequate planning, they can develop their sources of data and subject their planned approach to relevant tests. This will ensure they calculate their losses and plan in advance to mitigate them.

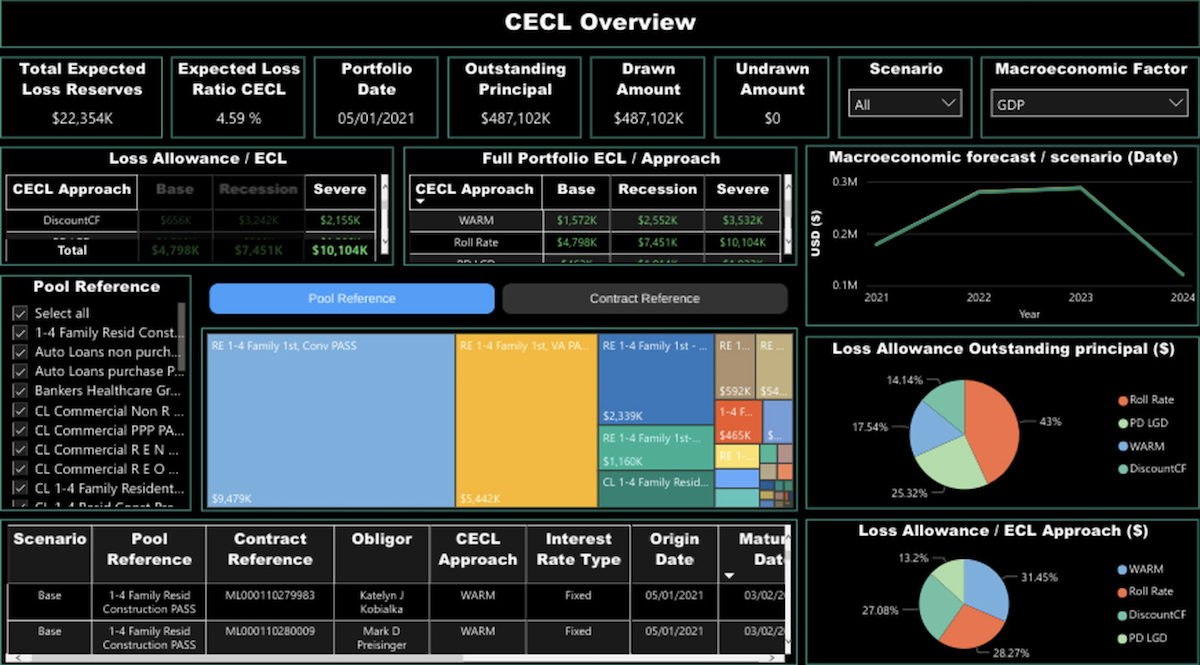

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.