THE FINANCIAL CRISIS AND BIRTH OF CECL

The 2007-2008 financial crisis triggered a cascade of credit losses for banks. It showed just how inadequate the longstanding method of Allowance for Loan and Lease Losses (ALLL) was for the adjustment of reserve levels of financial institutions. Taking note, on June 16, 2016, the Financial Accounting Standards Board (FASB) formulated Current Expected Credit Loss (CECL) to replace the ALLL standard. The CECL standard brought along with it a forward-looking component to anticipate the recognition of losses in a timely manner.

CECL and its impact on the banking industry

The impact CECL will have on the banking industry cannot be stressed enough. Some of these impacts are:

- The way loss modeling is calculated will change with CECL.

- CECL will decrease the profitability of some products and business lines.

- CECL will require financial institutions to make changes across credit risk modeling, capital levels, and risk tolerance.

- These institutions may also need to change their portfolio mix and business strategies.

- Data collection and modeling methodology will be impacted. Loss modeling will now consider a forward-looking component for the life of the loan, along with the current backward-looking component.

- The banking industry will need to pay heed to the impact of CECL during a financial crisis.

- With an increase in allowances, product pricing would change to mirror higher capital costs.

Delay in the effective date for the CECL standard for small banks

- On July 17, 2019, FASB came up with a proposal to push back the effective date of CECL. These new dates wilapply to smaller reporting companies.

- The board’s objective in offering additional time was to give relief to entities such as small banks that have limited resources and allow them more time to learn from and adapt to the implementation efforts of larger banks.

- Under the proposal, small community banks and credit unions must implement CECL by January 1, 2023.

- FASB also noted that due to their limited capacity to access technology and resources some smaller companies encountered more pronounced challenges and costs as they transitioned to an accounting standard.

The US Federal Reserve’s Scaled CECL Allowance for Losses Estimator (SCALE)

- The Scaled CECL Allowance for Losses Estimator (SCALE) was released by the US Federal Reserve in July 2021, to help small community banks implement CECL. These are banks whose total assets are under $1 billion.

- Publicly available regulatory and industry peer data is used by this spreadsheet-based tool to help small banks calculate allowances for credit losses that are CECL compliant.

- Starting with this tool, the bank management will need to adjust the amount to show their loss history and credit risk.

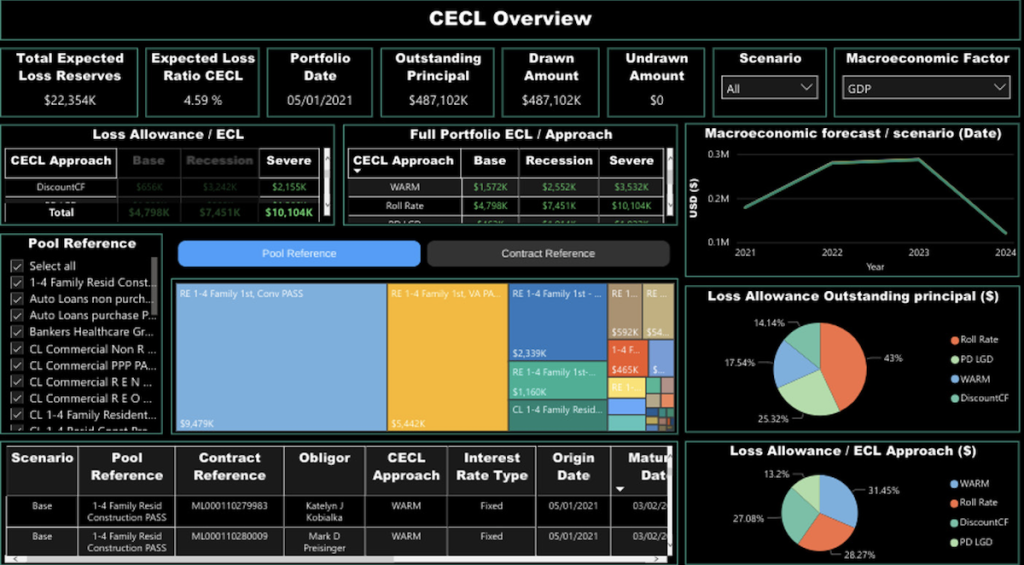

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.