The 2007-2008 financial crisis and credit loss estimation

The financial crisis of 2007-2008 demonstrated the inadequacy of existing methods, for adjustment of reserve levels of financial institutions when considering expectations of future market conditions. ALLL only relied on losses that were already incurred and did not factor in future cash flows that would end up uncollected. This resulted in disastrous errors in the adjustment of reserves for future expected losses. By mandating CECL, FASB hopes to improve the financial reporting of financial institutions through the estimation of future credit losses on various financial instruments and loans held by these institutions.

What is CECL?

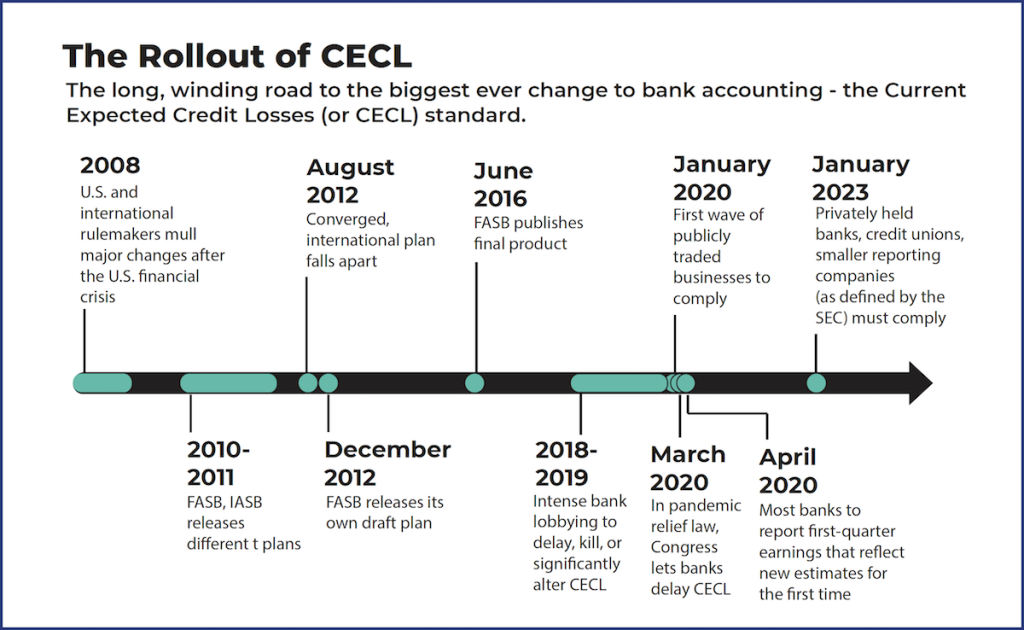

Current Expected Credit Losses (CECL), issued by the Financial Accounting Standards Board (FASB), is a new methodology for calculating allowances for credit losses. It came into existence on June 16, 2016, and was formulated primarily to replace the Allowance for Loan and Lease Losses (ALLL) accounting standard.

The need to replace the Allowance for Loan and Lease Losses

Every financial institution, including banks, encounters credit risk within its assets. In relation to this, ALLL is calculated as a reserve that these institutions need to establish. ALLL estimation posed its own set of challenges for financial institutions, including the significant amount of time taken for the reserve estimation process. Eventually, the FASB announced its plans to modify the manner in which banks account for impairment of assets by introducing the CECL model. CECL requires that companies include predictive, and forward-looking information while calculating their reserve for bad debts. As opposed to incurred losses, CECL requires an estimation of expected losses over the remaining life of loans.

How does CECL impact the banking industry?

Banks need to strategize and prepare for CECL implementation as soon as possible in order to meet critical deadlines. In 2020, at the onset of the pandemic, banks made changes to their financial reporting, specifically on how they account for loan losses. Several aspects of a bank’s operations, including risk, accounting and finance, and IT, will be impacted by the CECL standards. Impairment estimates, data management, technology, governance, and capital ratios are other areas where the banking industry would need to consider CECL.

Although early indicators are positive, it remains to be seen if the CECL accounting standard has resulted in a better insight into lending practices within the bank industry. FASB is constantly on the lookout for any changes to the standard that will make it more effective. They want the banking industry to cover future losses by setting aside reserves when these losses become more likely, and not waiting until they are in a cash-strapped situation following a systemic default event. The pandemic saw CECL in action when some of the biggest consumer banks in the US set aside nearly $18 billion in reserves as businesses shut down. These banks saw their net income and earnings per share shrink, despite not having incurred losses yet. In late 2020, as COVID-19 cases stabilized and there were signs of economic recovery, banks released some of their reserves, which stabilized earnings.

However inconvenient the adjustment of reserves maybe for the banking industry, government intervention in the form of CECL has actually proved to be a blessing in disguise. It can be likened to resurfacing from a storm shelter after a hurricane and watching the clouds clear away.

CECL Express can help…

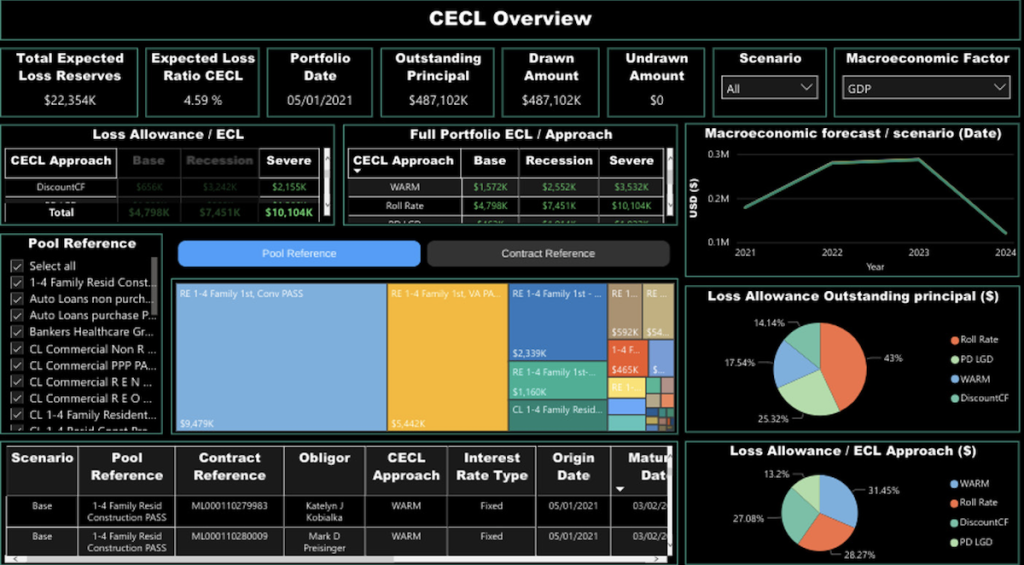

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.