THE CECL STANDARD

Recognizing the limitations the US Generally Accepted Accounting Principles (GAAP) faced while calculating impairment losses on financial assets, the Financial Accounting Standards Board (FASB) issued the Accounting Standards Updates (ASU) 2016-13 to change its guidance regarding impairment of financial instruments. Also, the ASU introduced the current expected credit loss (CECL) model, which focuses on expected losses rather than incurred losses.

The CECL model aims to:

- Reduce the number of credit impairment models that financial institutions use

- Require banks and credit unions to recognize an allowance of lifetime expected credit losses

- Use an expected loss model instead of an incurred loss model to remove any barriers to timely recognition of credit losses

Roll-rate method: A convenient way to measure expected credit losses

Under the CECL standard, there are several measurement approaches that financial institutions can use to estimate expected credit losses. Popular among these is the Roll-rate method, which uses historical trends in credit write-offs and delinquency. Historical roll rates are used to predict ultimate losses.

Historical experience may not accurately reflect an institution’s expectations for the future. Hence, institutions should add qualitative information to historical loss data as it is needed to reflect the current situation and generate projections that may not be fully captured by historical loss data. These qualitative factors are more popularly known as Q-factors. Q-factors are specific local area economic adjustments and reflect local conditions.

Q-factors and their relevance under CECL

Q-factors are almost exclusively local economic drivers that change the expected loss away from national or peer group averages. A few Q-factors that can play an important part in CECL calculations are:

- Lending policy procedures

- Credit concentrations

- Nature and volume of loans

- Problematic loan trends

- Collateral value

The Roll-rate method for estimating losses is calculated based on recovery rates and Q-factors. It is popular with banks since the data needed to drive those calculations is readily available at the pool level in the Q-report. This method is popular because roll rate is basically the loss rate currently adjusted for the economic conditions to get the forward rate.

Bank reported rates and their usability

- Banks can use annualized loss rates and then project forward what one-year losses can be. Usually, annual rates for the last five years are taken, and loss rates for the last quarter are factored in to get the annualized rate.

- Sometimes the call report from a bank or a credit union mention zero losses. This can derail CECL calculations and their accuracy. We have to start thinking of ways about how the last quarter will not influence the results. That is why it is preferable to average the previous five loss rates.

- If a bank or credit union chooses, it can use the peer group loss rate published by the National Credit Union Administration (NCUA) and the Federal Financial Institutions Examination Council (FFIEC). If a bank’s loss rate is far below the peer group loss rate, the bank examiner may expect it to use the peer group loss rate. If expected loss calculations are very low, it becomes harder to defend them in front of auditors.

- Banks can also use a default rate at the pool or bank level as it can be better defended during audits. This is typically the case when rates are being revised upwards, following a period of unusually low delinquency.

Allowance for credit losses calculations and audit considerations

While using the Roll-rate method, if the loss rates are deduced at the bank level, the amount of data needed to defend that rate during audits will be that much higher. Conversely, if the roll rate calculations are done at the peer group level, and we use the averages and macros as they come out, the amount of data to defend the results will be that much lower as the data used is from a reliable third party such as the FFIEC. It is also data that is available and recognized.

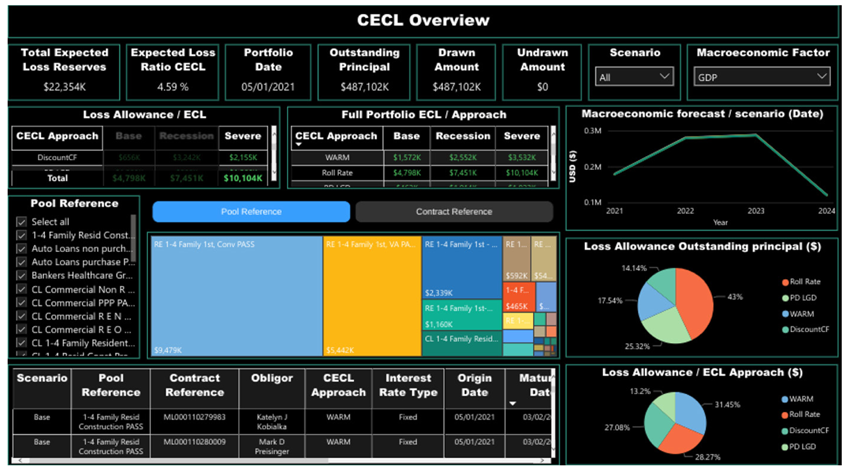

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.