CECL IS APPROACHING

In June 2016, the Financial Accounting Standards Board (FASB) provided us with a new expected credit loss accounting standard. The current expected credit losses methodology (CECL) was introduced by this new accounting standard to estimate allowances for credit losses. The effective date of CECL was pushed back by the FASB to January 2023 from January 2021 for smaller reporting companies. For non-public companies, it has been moved from January 2022 to January 2023. The definition of smaller reporting companies is as per the rules laid out by the Securities and Exchange Commission (SEC)

The FASB, On November 15, 2019, issued the Accounting Standard Update (ASU) 2019-10. This update pushed back the effective date for the CECL standard, ASU 2016-13.

CECL preparation

There are some crucial points to consider when we compute CECL and implement it. Financial institutions are required to factor in the below-listed points during CECL calculations and not focus on historical loss calculations alone.

- Historical Loss rate

- Forecasted Economic Conditions that are reasonable

- Qualitative Factors (Q-factors)/Current Economic Conditions

Historical data and loan classifications

Procuring historical loan data is not always easy for banks, and that data is often limited. Banks usually use previous monthly board reports for loan and delinquency information. They can use this information to forecast loss rate calculations.

Historical loan delinquency data can also be an effective tool to create granular loan classifications, enabling banks to categorize loans into different pools. Classifications, in effect, provide the ability to differentiate between all loans and ensure that loans are correctly and conservatively accounted for.

As an example, let us consider how automobile loans are classified within banks. The first classification pool would be where the loan is in good standing, and we term that pool as automobile or ‘automobile pass’. This pool has a specific set of curves, probabilities, and Q-factors against it.

Banks factor in the externally available FICO Score or the consumer credit risk score to make reliable credit risk decisions while lending money. FICO scores are helpful to CECL as they capture information about the borrower to which the bank may not have access. FICO collects data from multiple sources. If a borrower is stacking debt outside of the bank, even though they are paying down the loan on time each month, the risk should still be reflected if we want a near precise CECL estimate.

If a customer’s historical delinquency data and FICO score do not show any cause for concern, banks need not provide any extra and treat this pool normally. This depends on FICO and other factors, if everything is fine with the loan and it is in good standing,

If there are loans that are 30 or 60 days over and the FICO score has gone down to 100, the loans are classified as automobile special mention. This pool has a slightly higher probability of default. Likewise, if the FICO score goes down to around 600 or you are 60 to 90 days late, then at that point, you are down to sub-standard and heading towards default.

Delinquent loans are those that have not been paid past their due date. Delinquency is a range, and the longer a customer does not pay, the likelihood of defaulting increases. If we go even lower to around a FICO 650 and delinquency of 90 to 120 days late, banks put it down as a loss and write the entire notional off, and the whole amount is considered as a provision while estimating CECL.

Significance of Loan classification under CECL

Every CECL calculation pulls in the previous rate, macroeconomics, and Q-factors. Thus, when Q-factors are higher, banks add more provision to impacted pools.

In summary, FICO scores of customers fall when they approach multiple banks for loans. This increases their loan-to-earnings ratio, thereby decreasing their capacity to pay back the loan and decreasing the free cash flow. This also increases the probability of default. The problem with this is that banks do not refresh their FICO score often. Without an updated FICO score, banks rely on information such as delinquencies, which can lead to inaccurate CECL results. Therefore, the calculation of CECL should be a function of the delinquency data available at the bank level and the credit score, which is dependent on activities outside the bank.

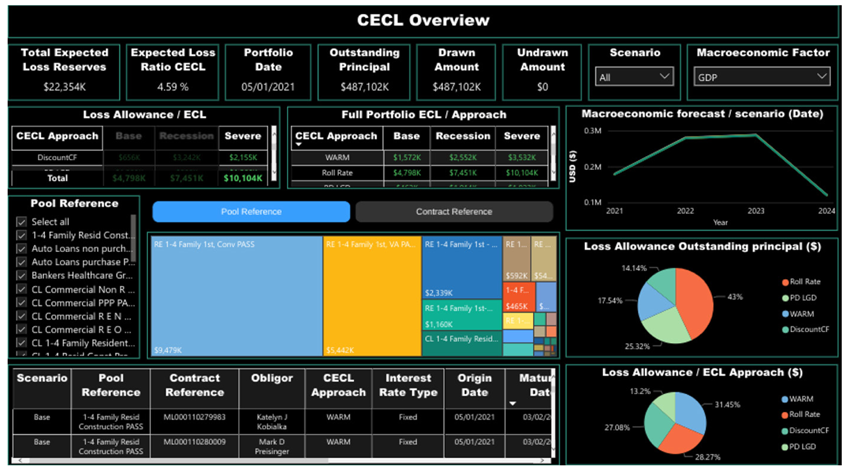

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.