CECL AND THE WARM METHOD

The Financial Accounting Standards Board (FASB) recommended the Current Expected Credit Loss (CECL) accounting standard for more timely recognition of credit losses to avoid any financial crisis-like situation in the banking industry. The CECL model is now based on expected losses and not on incurred losses. The FASB does not mandate any specific method when measuring credit losses under the CECL standard. One of the methods allowed is the Weighted-Average Remaining Maturity (WARM) method. In this article, we are going to dive deeper into the WARM method, explore its pros and cons, and why it is important to consider the granularity of portfolios when calculating CECL results.

Understanding WARM method

It has been observed that the WARM method is one of the more preferred methods of small US financial institutions as they work towards becoming CECL compliant. The WARM methodology lets financial institutions use the same average annual loss rate unlike most other CECL methodologies that calculate a specific lifetime loss rate.

WARM method features

- Calculation of the average annual loss rate

- Based on estimated prepayments and contractual maturities, estimating future outstanding balances

- Multiplication of the estimated outstanding balance by the average annual loss rate during future reporting periods

- Aggregating the estimated losses for each of these periods

WARM method example

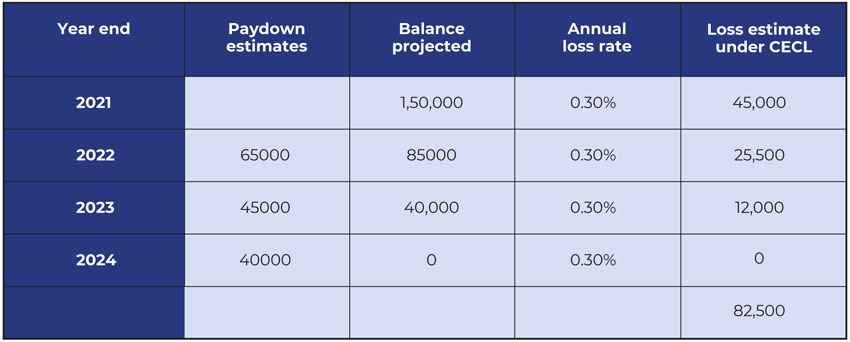

There is a loan portfolio with 150,000 dollars outstanding at the end of 2021 in this example as shown in the table below. The average annual loss rate for this loan pool has been calculated at 30 basis points. Under CECL, it has been forecasted that the entire loan portfolio will be paid down by 2024. To calculate lifetime losses, we sum them at the end of each year.

Example table

The historical lifetime loss rate = 82,500 / 1,50,000 = 0.55%

Primary challenges under the WARM method

- Qualitative factors (Q-Factors) need to be considered while using the WARM method. The historical loss rate will be adjusted for current and forecasted economic conditions.

- Forecasting adjustments can be challenging for some entities as it involves key economic indicators such as the consumer confidence index, unemployment data, and housing price index.

- The WARM method does not use loan-level information in the same constructive way as other methods do and does not allow banks to utilize the full potential of their data and analytics capabilities as they implement CECL.

Importance of loan portfolio granularity under CECL

Loan pools or segmentations should possess the same risk characteristics and should be as granular as possible. As the pools shrink in size based on their granularity, they might lose their size and statistical significance.

We can have a generic default loss rate number for the pool, or we can split the loan pool into:

- Pass

- Special mention

- Sub-standard

- Doubtful

This split ensures we have a This split ensures we have a different default for each one of them. The loss rate is different for each of them as the chance of default is higher for a sub-standard loan than a passing loan, and so on. If we do not separate these loans and just allow them to average into the WARM method, and if we take the bigger loss numbers that exist in the lower ratings and put them into one bucket, we lose the outliers and those outlying loss values.

There are institutions that, by just using the call reports, try to arrive at a CECL number. But, there are drivers within the WARM method, which is the loss rate factor that goes into it, plus the average maturities that will change that method. We have to be able to understand the difference in riskiness. We can do the weighted average using the portfolio, but we also need to split by the delinquency level of the loan as this will give us a different value. Hence, we get a matrix of values of different risk ratings of the loan and different maturities. We can do that by the default or we can do it with Q-Factors. However, if we do that with Q-Factors, we still have to be able to differentiate between passing loans, sub-standard loans, etc. We want to put different Q-Factors in to adjust for the higher riskiness. We can put a different default loss rating to drive it, or we can adjust it with Q-Factors. We have to do one or the other. We cannot simply take the number of the call report and do the WARM method as, while we do that, we do not change its driving influences.

Trade-offs institutions face while opting for the WARM method

- The WARM method cuts the computation time down as it does the averaging on the way in. But, we do not want to cut the computation time down to the point of losing the granularity of the portfolio.

- What is the purpose of using the WARM method in that case? The reason the WARM method is used, especially by Smaller institutions, is the lower computing power required to execute it.

- If the constraint of computing power is removed, would small financial institutions still use the WARM method? Are they aware of the granularity and the accuracy they are losing in the process? Firstly, the portfolio has got to be split based on riskiness because otherwise, there is a chance of averaging away the risk that should otherwise be captured. Secondly, if the WARM method is only being used because of its computing power requirements, then is that really the right choice?

- If banks and other financial institutions are going to choose the WARM method, they still have to subdivide their pools into riskiness since the pools will have different driving factors, whether they are default losses or Q-Factors.

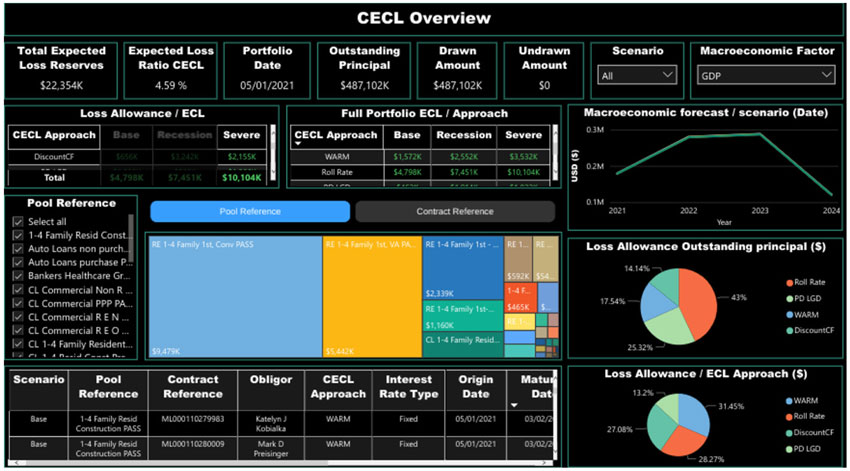

- The question then arises, why are these institutions doing WARM at all? There are methods that are arguably more accurate when it comes to calculating CECL estimates, such as Roll Rate, Discount Cash Flow, and PD/LGD. Roll Rate and Discount Cash Flow are computationally more expensive than WARM, but they are also more targeted. If institutions still want to opt for WARM after understanding all the pros and cons, then they have to subdivide the portfolio by riskiness to average the right pools.

If institutions are able to export the computing power cost associated with CECL calculations, then they should also be looking at a provider that offers more optionality in the methods. This way, they can choose a method that is actually right for their portfolio rather than choosing a method that has lower computational requirements.

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.