CECL UPDATES GUIDANCE ON THE MEASUREMENT OF CREDIT LOSSES

The Financial Accounting Standards Board (FASB) released a new accounting standard, the Current Expected Credit Losses (CECL) model in June 2016, updating the guidance on the measurement of credit losses for financial assets. The FASB has allowed a staggered adoption date for big and small Public Business Entities (PBE). The FASB has replaced the long-standing incurred loss model with the CECL model. The current estimate of cash flow that is not expected to be collected will decide the allowance for credit losses.

The FASB has allowed financial institutions the liberty to choose the model they want to estimate and measure expected credit losses as long as the method stays true to CECL principles. A significant change to policies and technology is expected to comply with the CECL standard.

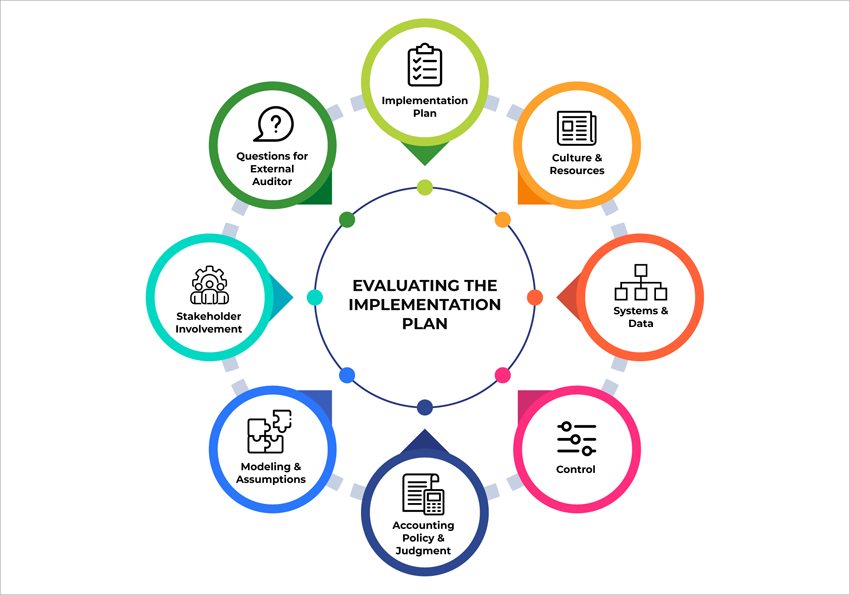

Audit implications with CECL

As the effective date for CECL implementation approaches, financial regulators are developing data and documentation requirements that will facilitate a smooth transition. Entities such as a bank’s internal audit’s risk assessments and audit approach will be changed by CECL. This accounting standard is likely to give rise to one or more significant risks of material misstatement due to factors such as estimation uncertainty and level of judgment on key data and assumptions.

CECL implementation is an institutional effort that includes internal audit, accounting, external audit, and other departments that have a stake. Internal audit should involve itself more in a monitoring role rather than be responsible for CECL implementation. The audit committee should hold management accountable as it goes about the CECL implementation process.

Governance of data in CECL

Life of loan and forward-looking CECL calculations need more data, thereby prompting banks to focus on developing strengthened processes for data gathering and retention. Data used in the credit loss estimate should be accurate, timely, and secure. Banks should decide where to source data from, the quantity, and how to use this data for a forecast methodology that will provide results that are auditable and relevant. Banks, while calculating the life of loan credit loss, will need to store additional data on a regular basis. Data ownership must be clearly established, with data requirements being auditable and well-documented. The FASB has directed historical loss information to be used to estimate expected credit losses for financial assets of a similar type and credit risk. Loan details that are expected to be saved every quarter include interest rate, book balance, and risk ratings. Greater quantitative support will be needed by examiners and auditors for qualitative factor adjustments.

When using forward-looking data and assumptions, management and internal audit will have to consider some implications. Small differences in assumptions can lead to a significant range of loss estimates. In fact, some new data may be sourced from external data sources and internal loan systems that were previously not subject to audit procedures and are not a part of traditional accounting systems. Auditors should also be mindful of potential management bias.

Portfolio segments

When loans are evaluated on a collective basis, similar risk characteristics should form the basis for their aggregation. These similar risk characteristics should be supported by accurate data for regulators and auditors. Strong internal controls are needed for these management judgments that are high-risk areas. To correctly forecast expected credit losses, credit exposures would need to be grouped by the management into portfolio segments with enough granularity. Also, if a loan’s risk characteristics are no longer similar to other loans in the pool, the banks must remove the loan from that pool.

CECL and loan origination

CECL would expand internal control requirements over loan origination. Within CECL, the loan origination could be considered a new process within the financial audit as it will create a loss expectation. Banks will have to identify and track factors underlying loss expectations. For example, appraisals underlying loan-to-value ratios on collateral.

Economic cycles and forecast period

Financial institutions such as banks will have to come up with the right forecast period. The nature of economic cycles is such that short periods of high charge offs follow several years of low levels of charge offs. To arrive at an actual loss expectation, management will need to make large adjustments. The FASB observes that life of loan loss expectations cannot be correctly estimated by recent history. As a matter of fact, several years of data would be needed by banks to support forward-looking calculations.

In conclusion, we can say that significant time and cross-functional resources will be required to successfully implement the new credit impairment standard. For a smooth transition, planning for data collection and documentation and developing new internal controls around the additional information will be required.

Final thoughts on how to get CECL to work for you

- Institutions should focus on designing systems and processes that do not overwhelm their existing manpower.

- Financial institutions will have to work around and modify their current allowance and other regulatory and business processes to deliver a more integrated solution capable of implementing CECL. This follows a realization that several aspects of the allowance process are already in use for stress testing and capital planning functions.

- Financial institutions need to account for the contribution of losses from all loans under the CECL standard as against contribution from only a subset of loans in the previous standard. This makes CECL a more computationally intensive process than the current incurred credit loss method. This means that institutions will have to ramp up efficiency of their model execution platforms.

- Lenders who seek the maximum application of CECL for their firms need to focus on the right architecture and adaptable framework, solutions that are modular with an open design approach, and also systems and processes that support iterative development cycles.

By now, most financial institutions should be well along on the path to implementing CECL. Firms that are aiming to be CECL compliant by 2023 will want to design and implement internal controls, run use-case scenarios, and start drafting disclosures. These steps will ensure a smoother and more timely transition to CECL.

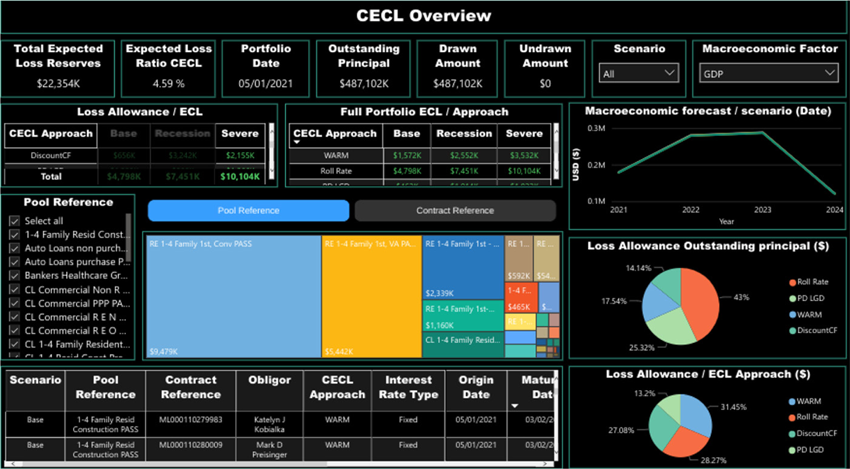

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.