CECL IMPLEMENTATION

In June 2016, the Financial Accounting Standards Board (FASB) issued the Current Expected Credit Losses (CECL) accounting standard. CECL focuses on estimating expected losses over the life of the loan. CECL’s effective date has been rescheduled from January 2022 to January 2023 for non-public companies, and from January 2021 to January 2023 for smaller reporting companies. Many financial institutions have already implemented CECL and are well into the process of fine-tuning the standard to adjust to their organizations’ framework. Those that have adopted the standard can now focus on their historical data and aligning it for auditing purposes. For those that have just adopted the standard or are about to do it, much can be learned from the experiences and mistakes of those pioneering institutions that have already tested the waters of CECL.

CECL data and historic comparisons

Historical loan data may be difficult to obtain. Banks can calculate historical loss rates based on this information. CECL also takes into account reasonable forecasted economic conditions and current economic conditions. Under CECL, historical loss experience cannot be calculated using the annual loss rate. When institutions finally have their CECL data in place and have implemented it, they need to make better use of this data. As a best practice, banks and credit unions can use this data and compare it between reporting periods. The benefits of these historic comparisons are listed below:

- When there is any discrepancy between data belonging to two different reporting periods, banks need to dig deep and investigate the cause of this anomaly.

- When institutions adopt best practice of comparing their CECL results from two different reporting periods, they can move to the next step, which involves using the data to solidify their organization’s accounting framework.

- Even if the economic conditions are relatively stable in any economy, there is a chance that CECL results can still undergo a swing between reporting periods. When this happens, institutions need to be prompt to investigate the source to stabilize their expected credit loss allowance and reserves.

- When institutions focus on historic comparisons of their CECL data, they ensure that they are ready with answers to any challenging auditing questions that may arise in the future. A good best practice would be to do the audit work before the auditor reaches there.

Rectifying CECL result deviations between reporting periods

As discussed earlier, when economic conditions are favorable and most macroeconomic factors are constant, any swings in CECL results should alert the risk management team of institutions. They can investigate these data deviations by:

- Checking market data and the performance of stock exchanges and financial instruments they deal in

- Digging deeper into loan portfolios and, if required, into the historic data of a loan itself to understand how it is being affected by factors such as unexpected losses, interest rates, credit risk, profitability, and liquidity

- The loan book of a bank or finance company shows the value of the loans it holds. In event of any CECL data deviations between reporting periods, banks can open their loan books and check them for their size, principal and interest amounts and data, and the balance sheet details.

- Investigating how market data fluctuations may be affecting the credit profile of a loan pool as these changes can become more pronounced over time if not checked early and rectified

- Making it a practice to compare CECL results between two quarters and identifying issues that may arise

The importance of storing each and every piece of data through reporting periods cannot be stressed enough. Documenting this data is equally important as it is the backbone of every institution’s audit reporting effort. A well-planned data store, supported by documentation that is meticulously put together will impress the most hardened auditors. To meet the expectations of auditors and regulatory bodies, preparers have to increase their documentation efforts and implement incremental controls. The five areas where auditors are expected to focus are:

- Models and methods used

- Qualitative adjustments

- Data

- Controls/Governance

- Assumptions

Auditors of accounting estimates need to do a high-level lookback analysis to understand the difference between previous estimates and actual results. This is one way for them to judge the management’s process reliability.

Frameworks put into place by adopting the above-discussed best practices can help institutions avoid any audit-related shocks and pass those audits without glitches. These frameworks can then be put into auto mode to check and verify historic comparisons of CECL data using methods such as trend and stress analysis.

Making historic comparisons between reporting periods has often been an area that has been neglected by financial institutions. CECL implementation and the associated auditing requirements will go a long way in ensuring that these valuable results and data are no longer neglected.

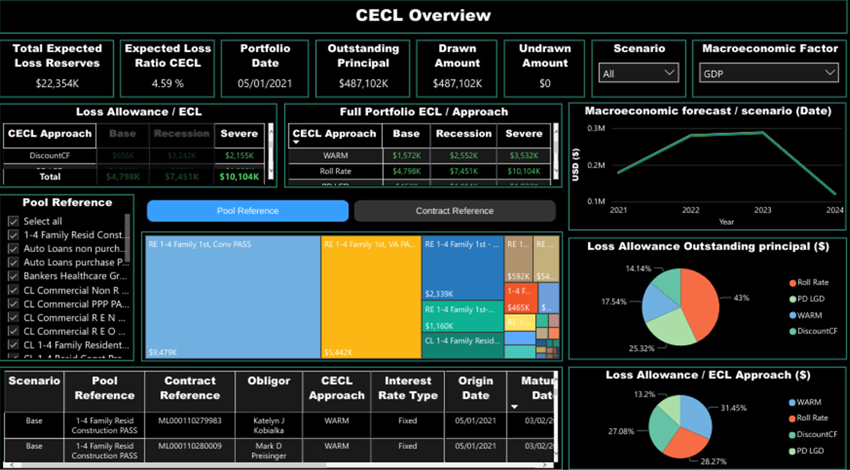

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

Yield curves and Fed data

Linked reports on losses from the FFIEC and NCUA

PD and LGD curves Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.