CECL OPTIMIZATION AND ABSOLUTE COST

The Current Expected Credit Loss (CECL) accounting standard, which was issued by the Financial Accounting Standards Board (FASB), provides for more timely recognition of credit losses. One of the key aspects of CECL is to select the right methodology to estimate the Expected Credit Losses (ECL) so that institutions can cover these losses by holding the right allowance.

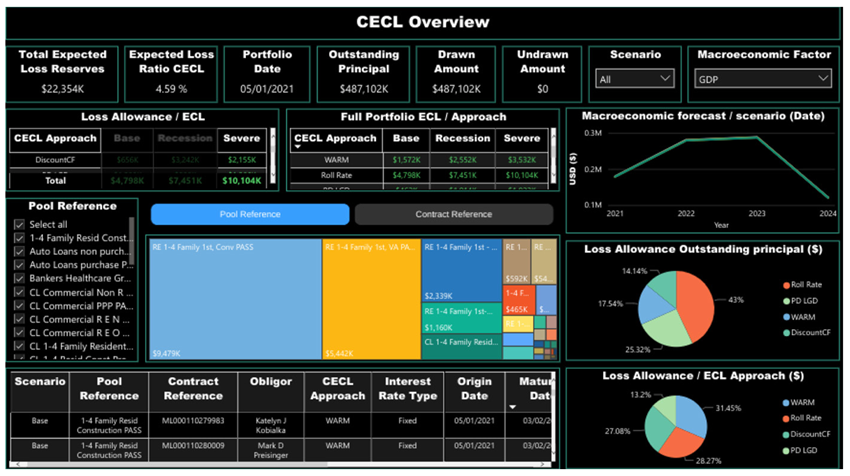

Each CECL method gives us a different result. Banks and other institutions can optimize by checking which method will give them the lowest CECL result and then choose an appropriate one. This will give them maximum capital to channel into the markets, as consequently, they will need to hold the least amount of cash as risk capital. The lowest CECL estimate is also called Absolute Cost.

The challenge, when it comes to this approach, is the possibility that the next CECL estimate could be much higher. This will pose a liquidity problem for banks that do not have these kinds of reserves and would therefore need to make up for it by selling assets. Some banks may tackle this liquidity problem by creating an extra buffer of reserves over and above the capital CECL asks them to hold.

Risk appetite management

While institutions might find it appealing to opt for methods that give the lowest CECL estimates, they will have to manage the corresponding risks by building a capital buffer. The size and scale of the buffer an institution creates around its CECL reserves would indicate its risk appetite. A zero buffer would mean a higher risk appetite where a bank may decide to deal with liquidity issues when it confronts them. A huge buffer would mean that the bank is averse to taking risks and wants to cover for any surprises that may arise.

Another way that an institution might choose to manage its risk appetite would be to calculate CECL using the current scenario and then calculate it for an extreme scenario (where factors like unemployment, housing, and gross domestic product are amplified). This will help them understand which method’s results move the most and which ones move the least. Consequently, it indicates which methods are most sensitive to market movements and which ones are least affected. Banks can then pick methods, which do not cause drastic changes in CECL numbers and therefore manage their liquidity flows better.

Volatility of CECL results

As discussed above, certain CECL methods can produce more volatile results than others. Institutions that are looking to reign in this volatility might advise their Board of Governors on which method to choose to stay within their buffer limits. But if the board decides that they want to save as much capital as they can and channel it back into the markets, they might optimize and choose the method with the lowest result. The risk-averse nature of the board would ultimately decide how they deal with CECL volatility.

Institutions will realize that the way they manage their buffers is nothing but best practices when it comes to liquidity management and also optimization against the volatility of results. CECL has introduced a much-needed and improved measure of liquidity management on how banks function. Despite being an accounting standard that counts losses, CECL also has a predictive risk management aspect to it that has an impact on liquidity.

One of the reasons banks have got a couple of years to prepare for CECL is to familiarize themselves with the predictive methods and be ready for the liquidity implications by maintaining relevant provisions. It needs to be understood that under CECL, even if there are no historical losses, you would still make provisions for expected losses based on averages derived under the standard.

CECL, risk management, and return on investment

Most regulations, such as CECL, require more capital to be held in reserve to account for predictive losses. This means less capital for banks to put into the market and, thereby, significantly lower returns. The 2008 financial crisis ensured that appropriate regulations such as CECL were put into place so banks would have sufficient capital to deal with any market shocks. Measures were put into place to ensure that institutions managed their risks while making decent profits and staying in business. This financial safety net saw to it that it was that much more difficult for banks to fail and for depositors to lose all their savings. CECL regulators had the unenviable task of ensuring that the public was protected while allowing cash to flow through the economy. Under CECL, smaller banks faced a tremendous challenge when it came to maintaining reserves and managing day-to-day operations.

In the longer term, CECL ensures that banks maintain a good grip on their liquidity management through sound risk appetite practices. This development should potentially lead us to a robust banking system and an economy that works for all.

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.