PROBABILITY OF DEFAULT (PD) UNDER CECL

Most financial institutions, such as banks and credit unions, regard the Probability of Default/Loss Given Default (PD/LGD) technique as a reliable method for determining suitable reserve levels in an institution’s loan and lease loss allowance. The PD/LGD method has quickly become the preferred one in the Financial Accounting Standards Board’s (FASB) Current Expected Credit Losses (CECL) guidance. While the method is straightforward, the amount of data needed to derive input values may be daunting. The effectiveness of the estimate is what makes PD/LGD so appealing to organizations looking to improve their risk management process. To ensure that the inputs for this calculation are an accurate reflection of loss in an institution, there needs to be a consistent approach in the collection of loan-level

data used for the PD/LGD method.

Quantification of credit risk and the FICO score The quantification of credit risk is an important concept in modern finance, which involves the process of assigning comparable and measurable numbers to the possibility of default risk. Credit risk is influenced by a variety of factors, ranging from borrower-specific criteria to market-wide issues. Liabilities can now be evaluated and projected to safeguard the lender from financial loss.

Variables that influence credit risk evaluation:

- The severity of the outcome of a default for both the borrower and the lender

- Borrower’s financial health

- Size of the credit extension

- Macroeconomic considerations such as interest rates and economic growth

- Default rate trends

The FICO Score

The analytics software company, Fair Isaac Corporation (FICO), has created a credit score known as the FICO score. Institutions such as banks decide whether to issue a credit by assessing credit risk based on a borrower’s FICO Scores. These scores determine the creditworthiness of borrowers by taking into account data in five areas that are mentioned below:

- New credit accounts

- Payment history

- The types of credit that were used The degree of indebtedness Duration of credit history

FICO Scores range from 300 to 850. Credit histories with scores between 670 to 739 are considered good. More than 90 percent of the credit decisions made in the U.S. are based on FICO Scores. Many lenders approve credit only when a certain FICO minimum threshold is reached. This is true, especially in the mortgage industry. To achieve a high FICO Score, borrowers should maintain a good payment history and keep credit card balances within the allowed limits.

Credit scores and the PD/LGD method

All the variables discussed above and credit scores such as the FICO Score are used as data in the PD/LGD method while estimating CECL allowances. Each and every loan pool is run through the PD/LGD calculations to understand credit losses. These calculations give banks an idea of the kind of reserves they need to build to cover all potential credit losses. To understand the CECL method, we need to be familiar with only three of its main inputs to estimate lifetime losses. The challenge, however, is calculating these inputs. These three variables are explained below.

1) Probability of Default (PD)

- Credit score

- Debt-to-income ratio

The PD for businesses is estimated by credit rating agencies. By committing collateral against a loan, borrowers can share the risk of default. A higher PD translates to higher down payments and higher interest rates on a loan

2) Loss Given Default (LGD)

There is no standard method when it comes to calculating LGD. Most lenders review an entire pool of loans and judge the total exposure to loss while calculating LGD, and do not just calculate LGD for each loan separately. The institution must calculate the estimated loss rate if a loan is defaulted using past data on defaulted loans. For current and/or expected changes, the institution may adjust the loss given default rate.

3) Exposure at Default (EAD)

When a loan defaults, institutions must estimate the principal balance of the loan at that point. Though EAD is more relevant to financial institutions, it remains an important concept for any individual or entity.

After estimating the above variables through some analysis of historical information, the expected lifetime loss can simply be obtained by multiplying them together.

Advantages of the PD/LGD method

- It is more accurate than other methods because it takes into account more quantitative information.

- In this method, qualitative factors can be considered directly rather than adding them to the quantitative part later as is common in other methodologies.

- The lower reliance on subjective factors leads to a smaller CECL allowance for credit losses in the PD/LGD method.

- It is simpler to tie the loan rate to the credit score and, consequently, to the CECL assessment. A higher FICO score translates to a lower loan rate and a smaller CECL estimate and allowance for institutions. This ease of use makes PD/LGD a preferred method among auditors and regulators alike.

Disadvantages of the PD/LGD method

- The precision of this method requires more data in order to calculate the three inputs to the model.

- Economic factors will need to be adjusted for current and forecasted changes due to their effects on the variables.

- Specialized software will be needed for all the extra calculations and statistical analysis required by the method. Such investments are not possible for small banks and institutions.

- Individuals can manipulate their spending and repayment habits in the short term to raise their credit scores. This in turn could influence CECL calculations through the PD/LGD method.

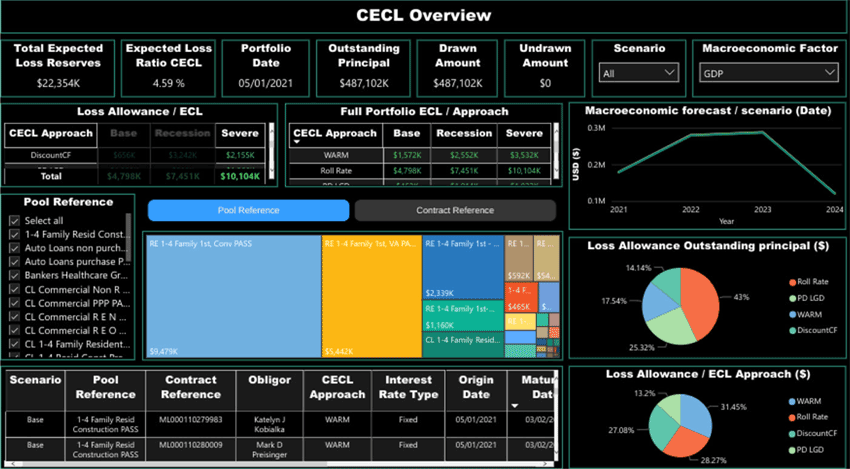

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC

- and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.