DISCOUNTED CASH FLOW (DCF) METHOD AND ITS RELEVANCE TO CECL

Notwithstanding the 2023 effective date, financial institutions are already working to have systems and procedures in place to implement the Current Expected Credit Losses (CECL) standard. Developing a technique for calculating the allowance for expected credit losses is one of the most important aspects of adhering to CECL. Financial institutions can choose from a variety of methods, some of which are better suited to specific products than others. Methods range from the Weighted-Average Remaining Maturity (WARM) method, which is preferred by smaller institutions, to more complicated ones, like the Discounted Cash Flow (DCF) method. The number of resources and data available to an institution will most likely determine which method the management chooses while calculating their CECL allowance. While the DCF method is widely regarded as complex and data-intensive, it is still considered by many institutions to be best suited for estimating their credit loss allowance.

How do contractual cash flows compare to discounted cash flows?

DCF is the most comprehensive of the CECL methods, and it is typically utilized by larger organizations that require more information and control. Before we explore DCF, it would help to understand the similarities and differences between discounted cash flows and contractual cash flows. An institution’s core system contains data for factors such as:

- Payment type

- Interest rate

- Payment amount

- Payment frequency

- Maturity date

- Amortization

These factors typically come together to give us contractual cash flows. The cash flows for a loan can be projected using this data. Contractual cash flows can be converted to expected cash flows by making a few assumptions, which have been explained below.

Prepayment rate

The annual proportion of a loan’s outstanding balance projected to be paid off early is known as the prepayment rate. Prepayment can be of several different types, such as refinance, partial, or full. The effective duration of a loan reduces as the prepayment rate and, consequently, prepayments increase. This means less interest for the lender and is considered a prepayment risk. This can impact the timing of cash flows and also an institution’s CECL estimate.

Probability of Default (PD)

The chance that a borrower is going to default is the probability of default. It is expressed as an annual percentage and is adjusted on a period-by-period basis. The credit quality of the borrower determines this metric. An institution that follows the DCF method can change how it deals with its borrowers if it senses that their ability to repay loans is challenged. This is because the DCF approach brings with it a vectored default rate forecast.

Loss Given Default (LGD)

During the estimation process, institutions should use a DCF or non-DCF technique regularly. If a non-DCF approach is used, it has to be applied uniformly to a portfolio. Historically, there has been a lack of consensus on whether LGD should be partially discounted, discounted, or not discounted at all. While implementing CECL, institutions using a DCF methodology should apply a discounted LGD while institutions using a non-DCF-based estimation should apply a non-discounted LGD. For both DCF and non-DCF methods, partial discounting should be avoided.

Recovery delay

Institutions face a delay in recoveries when a loan goes into default. In DCF models, timing is crucial since the delay time has variable effects on the CECL calculation. Based on loan classes, this is often applied across the board.

Discount rate

The discount rate, also known as the effective interest rate, is the contractual interest rate that has been adjusted for any net deferred fees, expenses, premiums, or discounts that existed at the time of origination.

CECL forecasting

CECL’s technique needs forward-looking projections. Because of its timing abilities, the DCF approach is best suited for forecasting. While running various scenarios for different forecasts, an institution can include them in a discounted cash flow. Projections would also consider current conditions, the standard historical experience, and reasonable and supportable forecasts.

DCF advantages

- By considering all cash flows and modifying them for behavioral and credit-related elements, the DCF method then calculates contractual life.

- DCF can incorporate supportable and reasonable forecasts based on volatility and timing.

- DCF depends more on facts and less on

DCF disadvantages

- The method is highly complex

- It needs a lot of data, both historical and current

- It needs software and related resources to run effectively

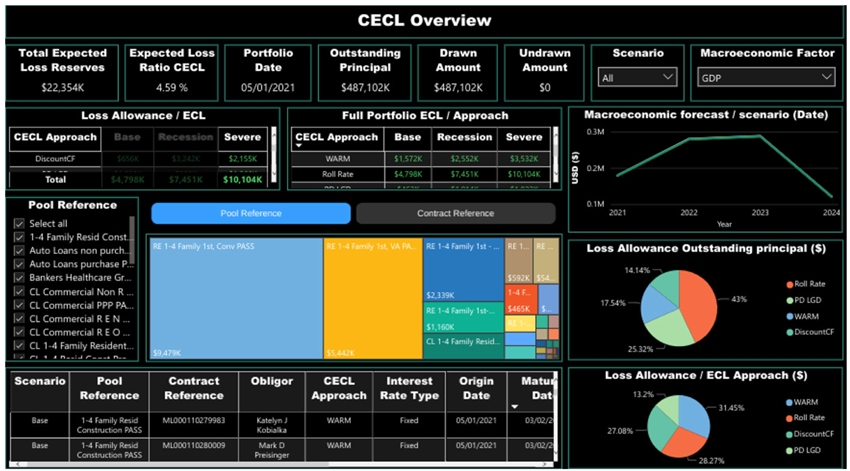

CECL Express can help…

CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. The system provides all non-loan data, including:

- Yield curves and Fed data

- Linked reports on losses from the FFIEC and NCUA

- PD and LGD curves

- Macroeconomic data

Banks and credit unions need to only provide the underlying loan details for the system to provide fully auditable ECL results for multiple calculation methods, including:

- Vintage

- Roll Rate

- Discounted Cashflow

- WARM

- PD/LGD

CECL Express provides more than valid ECL results. The system computes results for all methods and all loan pools, allowing the bank to optimize its CECL configuration and avoid the worst impacts of the new standard.